A new shirt, a trendy pair of sneakers, and numerous espresso drinks from Starbucks were just some of the frivolous items that led to my financial demise. I was twenty-one-years-old, I loved shopping, I had student loans, and I had just gotten my first credit card. It was a recipe for disaster. I saw my new credit card as a beacon for endless opportunities, but it quickly became the complete opposite.

In a matter of only a few months, I had completely maxed out my credit card’s $1,500 limit. I understand that $1,500 may not seem like an unreasonable amount of debt, but as a college student who had bills and worked only part-time, it felt as if I was being suffocated.

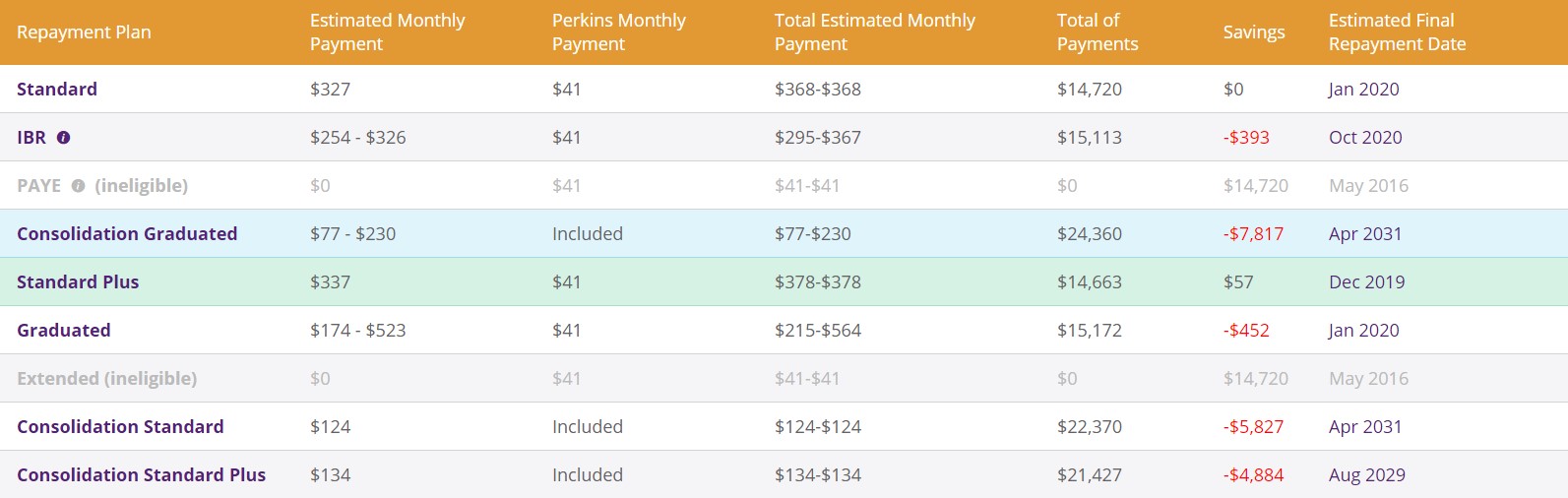

On top of maxing out my credit card, I was about to graduate. That meant I would need to start paying back my student loans in the near future. So, I decided to use IonTuition to figure out how much my student loan payments could potentially be. Here are some of the repayment options IonTuition said I could be eligible for, as well as the forecasted payment amount:

Depending on what repayment plan I chose, my monthly student loan payments could range anywhere from $77 to $523. Thinking of this put me in a state of panic. How was I going to pay off my credit card?

In a desperate attempt to make myself feel better, I tried to rationalize all of my purchases that placed me in this predicament. “I spent $50 on paint supplies because painting reduces stress. I spent $110 on a pair of Adidas sneakers to better support my feet (I have high arches!). I spend $65 at Barnes and Noble on a leather journal and a few pens because I’m trying to write a book.”

Once I got through the entire list, I didn’t feel better – I felt much worse. I realized that a very small fraction on that list were things I actually needed. My rationalization was nothing more than an excuse for my horrible spending habits.

With a bit of self-reflection, I realized that while I was racking up all that debt, I convinced myself it wasn’t really there. I did the same thing with my student loans. I told myself it was a fictitious number and that I would pay it off when I was more financially stable. “I’m still a student after all,” I told myself.

The choice I made to ignore my debts negatively impacted my life in multitude of ways. I found myself stressed, upset, and even angry. The credit card was supposed to be for emergencies. It was supposed to help me build a credit score, and it was supposed to open the door for opportunities. My lack of financial responsibility caused my credit card to do the exact opposite of what I intended. Once I accepted that I was at financial rock bottom, I knew that I couldn’t ignore the issue any longer.

Luckily for me, I had just received my tax return. Typically, I use my tax return to take a vacation. Unfortunately, I wouldn’t be doing that this year; I would be using it to pay off my credit card. I knew this was the right choice, given my upcoming student loan payments. Using iontuition to forecast my upcoming student loan payments gave me a visualization to make this kind of positive, responsible choice.

This was an extremely hard lesson for me to learn, but also one of the most valuable. It taught me the importance of a budget , spending less than I make, and actually paying off my debt each month. I intend to use what I learned in my future financial endeavors such as repaying my student loans, renting an apartment, or buying a car.

If you’re in a similar situation, I encourage you to check out our blog series featuring practical advice from personal finance experts. To fuel yourself with even more financial responsibility, create an IonTuition account to see what your student loan payments could look like after graduation. It may seem like a lifetime away, but a little preparation now will save you a world of money in the long run.