Looking back at high school, I wish they dedicated a course to budgeting. My peers and I graduated very little knowledge pertaining to financial literacy, and that is a problem. One of my favorite sayings, knowledge is power, can be applied to this situation. If more students graduated high school with a good understanding of budgeting, they would be able to effectively manage their money, and be more successful in the future with their personal finances.

It wasn’t until my freshman year of college that I realized I didn’t know how to do basic things like create a budget, balance a checkbook, or pay my credit card on time. I was frustrated, and I knew needed to make better choices with my money. I decided I would take my financial education seriously. (This was my hunger for budgeting knowledge)

After a simple Google search, I came across the company that I now work for, iontuition. iontuition is a web-based portal that is packed with tools to help students manage their finances. (This was my Google search) When I was first introduced to all these tools, I decided to remain skeptical until proven otherwise. Could these tools be the resources I was looking for? I wanted to see for myself just how well these tools could ease the stress of money management for a college student.

I wanted to learn more about financial literacy, so I visited the ionLearn tool. There, I was able to personalize my learning experience. If you are like me, you learn better when you have different mediums to choose from. I found a lot of valuable resources such as a large selection of videos, a glossary, and financial FAQs (which I really enjoy because I learn a lot from other peoples’ questions). It was a relief to have a reliable resource to look up any term I was unsure of.

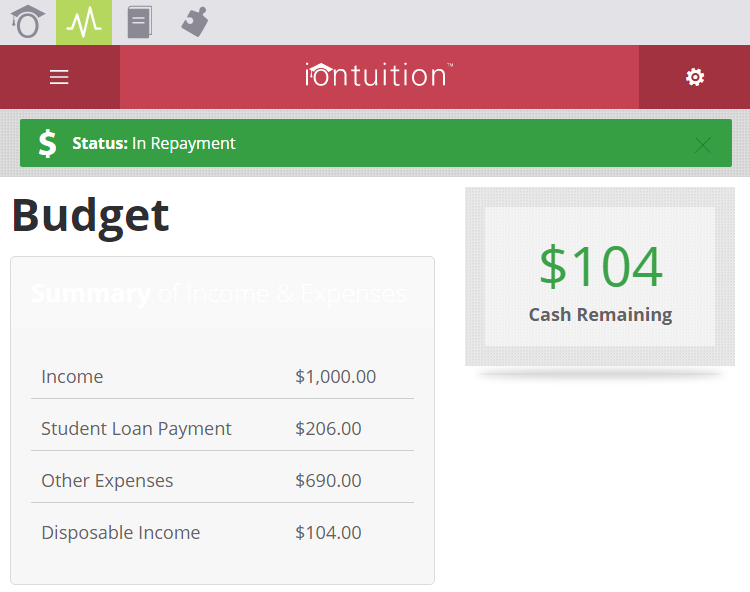

Another tool that has made my life easier is the budgeting tool in ionManage. When I first tried using a budget, I used a pen and paper. I quickly found out that was not going to work for me. I would always forget to write down items I bought or I would lose the receipt. So, when I saw that iontuition offered a budgeting tool, I was excited to try it.

Having the ability to access to my budget whenever I need it has made my life so much easier. I set up notifications through ionManage that remind me in advance when payments are due, so I am never late on a payment.

I believe that money management skills are some of the most valuable skills a person can have. That is why I am so passionate about sharing this knowledge with you. After learning about financial literacy and money management, I came up with three simple steps on how to create a budget.

Step 1: Determine how much money you have (total income)

– Money from job, work-study, summer employment etc.

– Money from parents

– Student loans, grants, scholarships

– Money gifted to you

Step 2: Determine what costs remain close to the same each month (fixed costs)

– Tuition and fees

– Room and board

– Rent

– Credit card

– Health/car insurance

– Car loan

– Phone bill

– Cable/ internet bill

– Books, supplies, class fees

Now subtract your fixed costs from your total income. This will determine how much ‘disposable money’ you have.

Step 3: Determine what costs vary each month (flexible costs)

– Entertainment

– Going out to eat

– Transportation, parking, car maintenance

– Personal expenses

– Clothing

– Electronics

If you find that your flexible costs exceed your total income, then you should reevaluate your budget and cut back on expenses. I recommend going through your flexible costs, eliminating as much as possible, and using that money for an emergency fund or savings.

Budgeting doesn’t have to be an elaborate process. When you break down your income and different types of expenses you are able to see a clear picture of your finances. As a college student myself, I am aware that saving money is extremely difficult, but if you make budgeting an innate process—saving money will come easy.

I encourage you to sign up for an iontuition account and to use the budgeting tool. You won’t be disappointed.

As Blogger and budget aficionado, Tara K. helps students across the country enhance their knowledge about money management and everyday life. She is constantly looking for new ideas to transform into great advice for you. Pursuing a journalism major, Tara K. has a passion for the art of inquiry, which is conveyed through her writing.