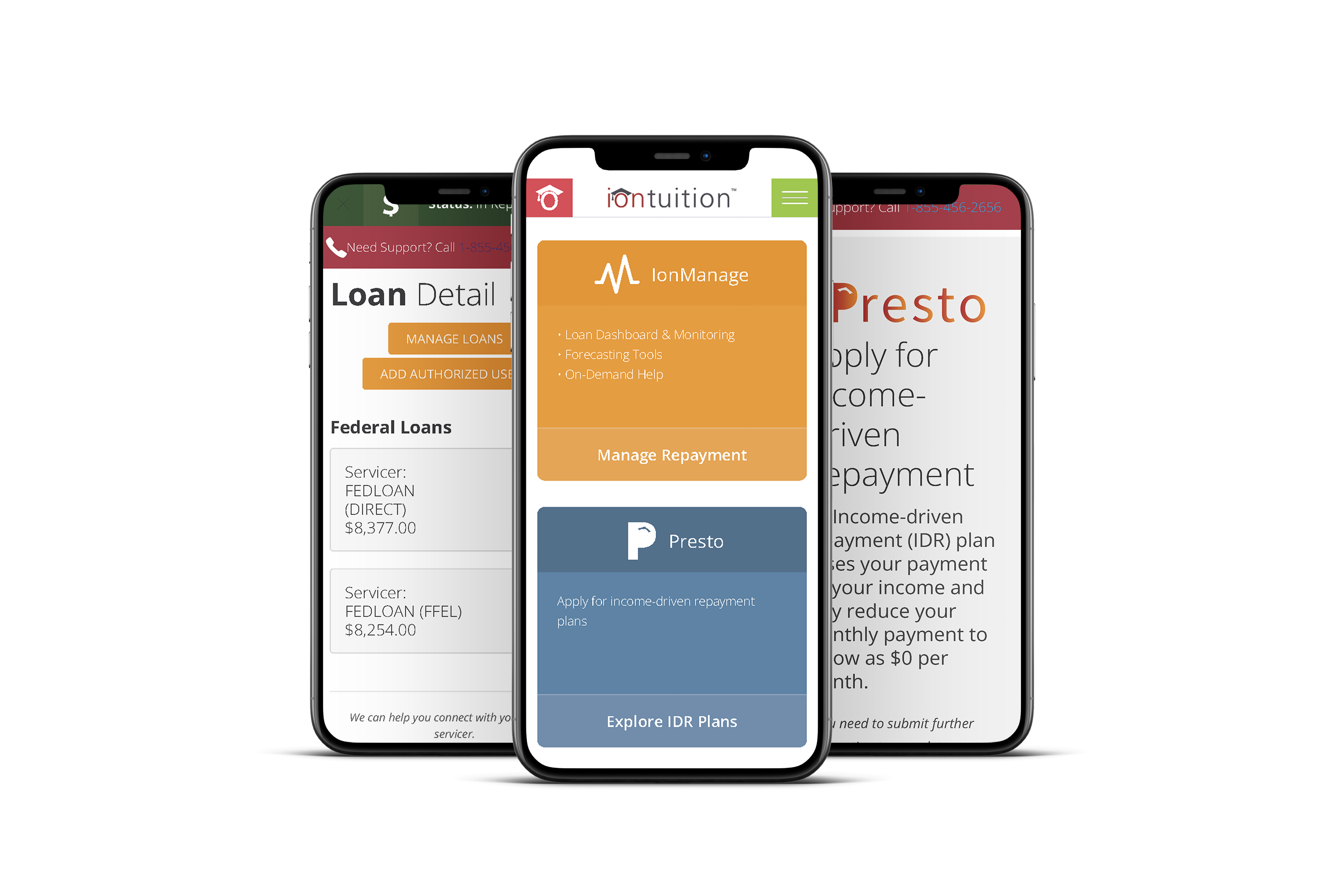

Streamlined Dashboard.

View all federal student loan information on one dashboard. Loans are imported automatically – no manual data entry.

Streamlined Dashboard.

View all federal student loan information on one dashboard. Loans are imported automatically – no manual data entry.

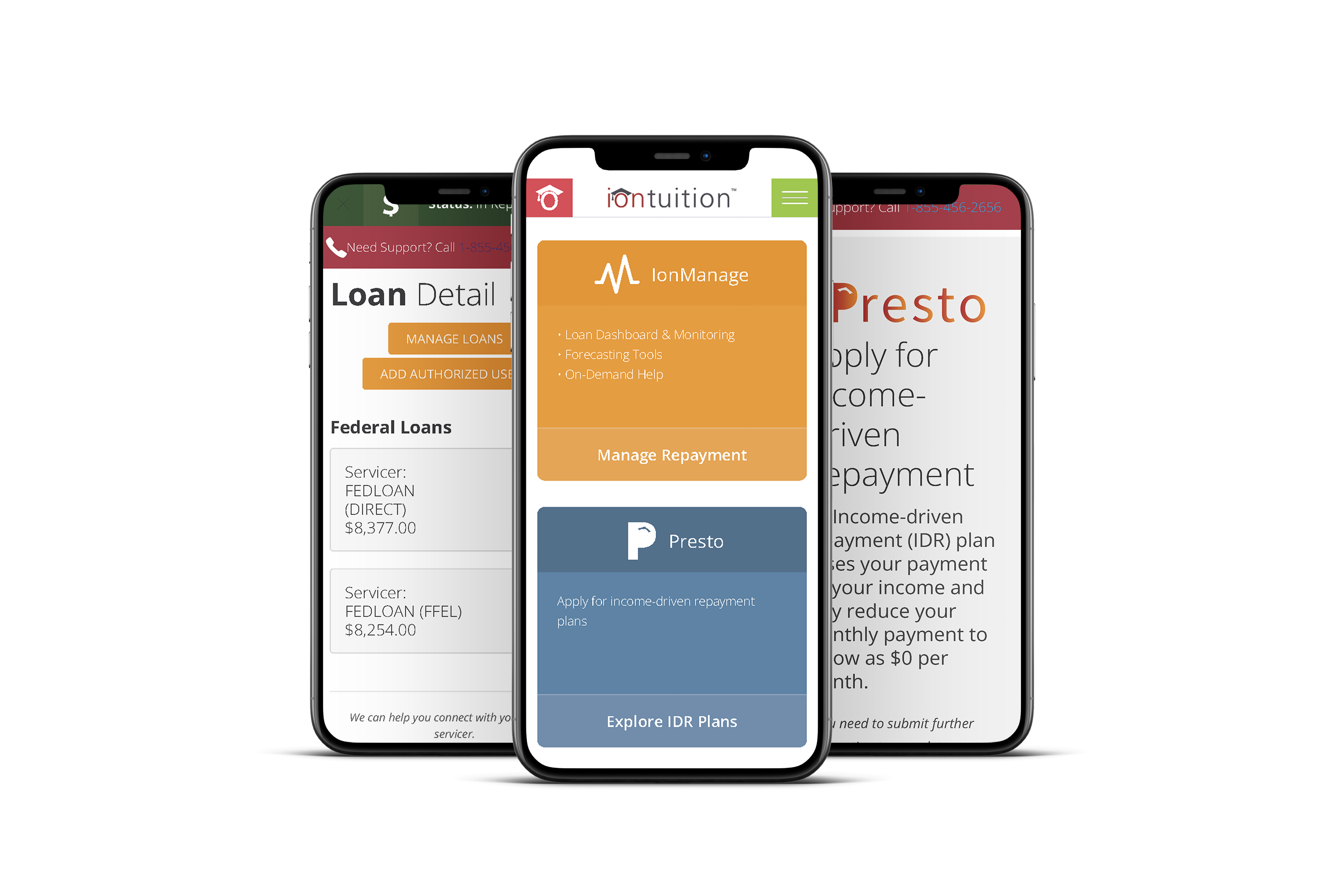

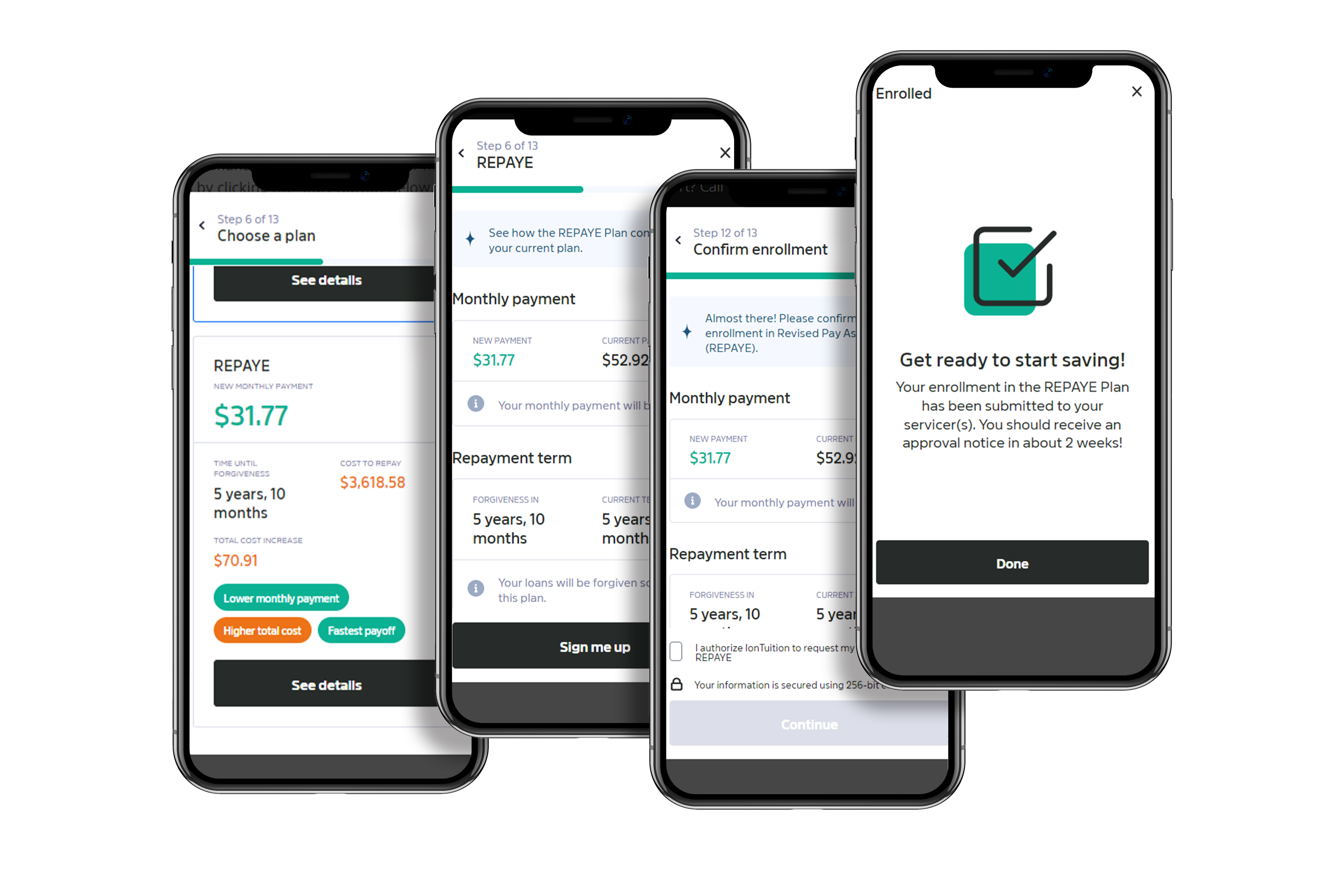

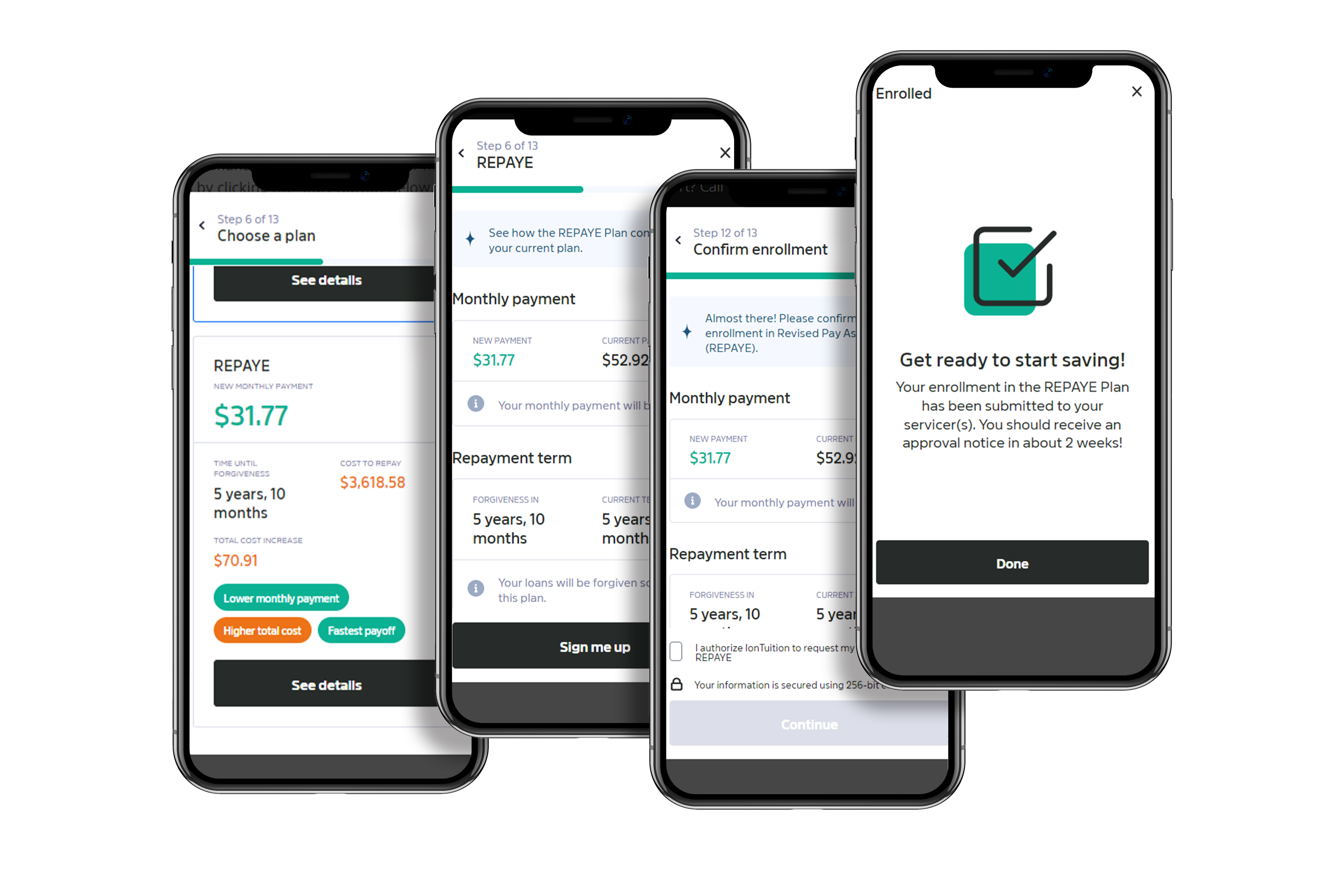

Repayment Planning.

Lower your monthly payments by applying directly for an income-driven repayment plan.

Repayment Planning.

Lower your monthly payments by applying directly for an income-driven repayment plan.

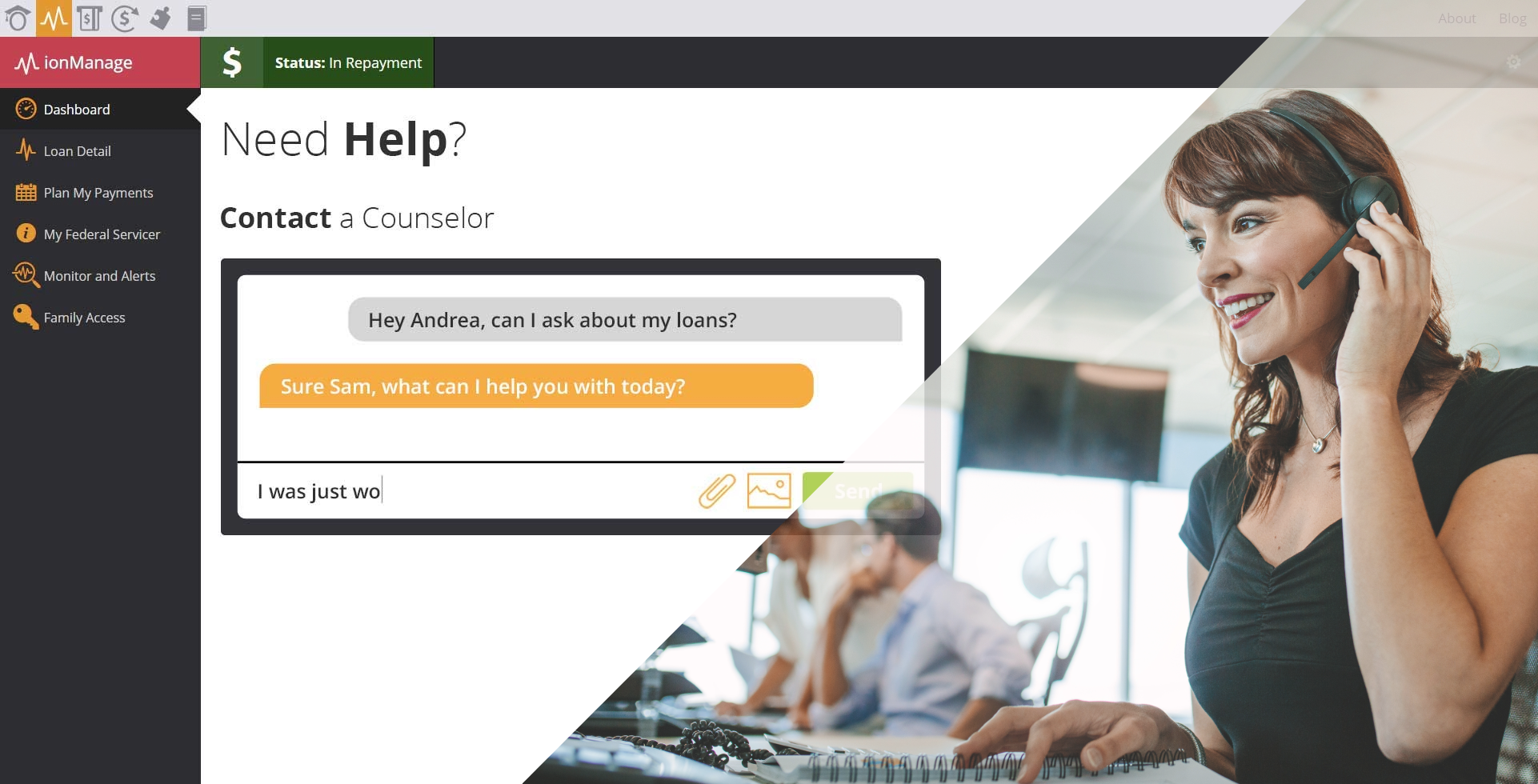

Trusted Help.

IonTuition users can call or chat with student loan repayment specialists and avoid long wait times with federal servicers.

On-Demand Help.

Help.

Call or chat with student loan repayment specialists and avoid long wait times with federal servicers.

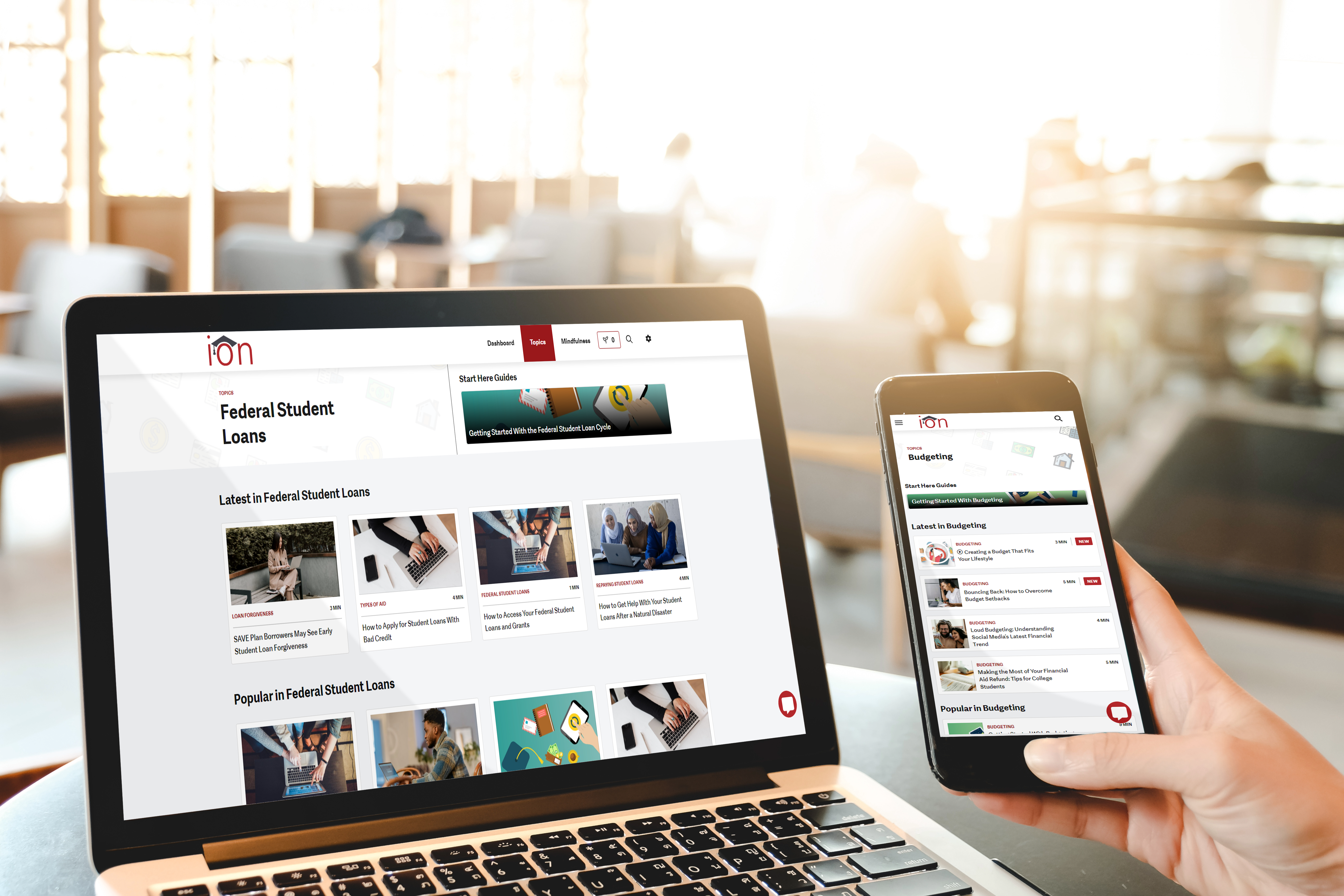

Financial Literacy.

Overcome financial stress with content customized to your needs.

Financial Literacy.

Overcome financial stress with content customized to your needs.

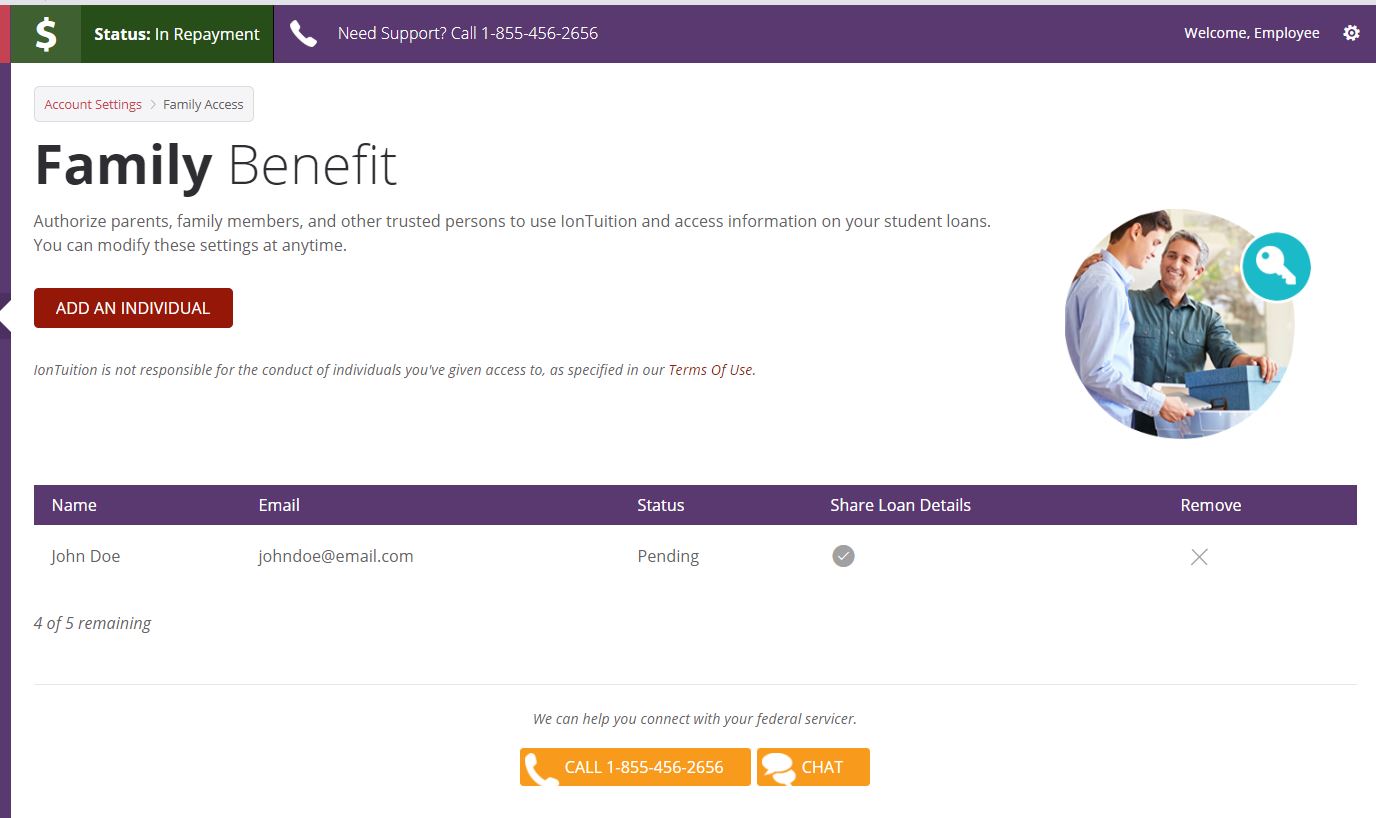

Access for Family.

Invite family members to create their own IonTuition accounts.

Access for Family.

Invite family members to create their own IonTuition accounts.

Mobile-First Design.

Access IonTuition from any device. Receive automated alerts if there changes to your repayment.

Mobile-First Design.

Access IonTuition from any device. Receive automated alerts if there changes to your repayment.