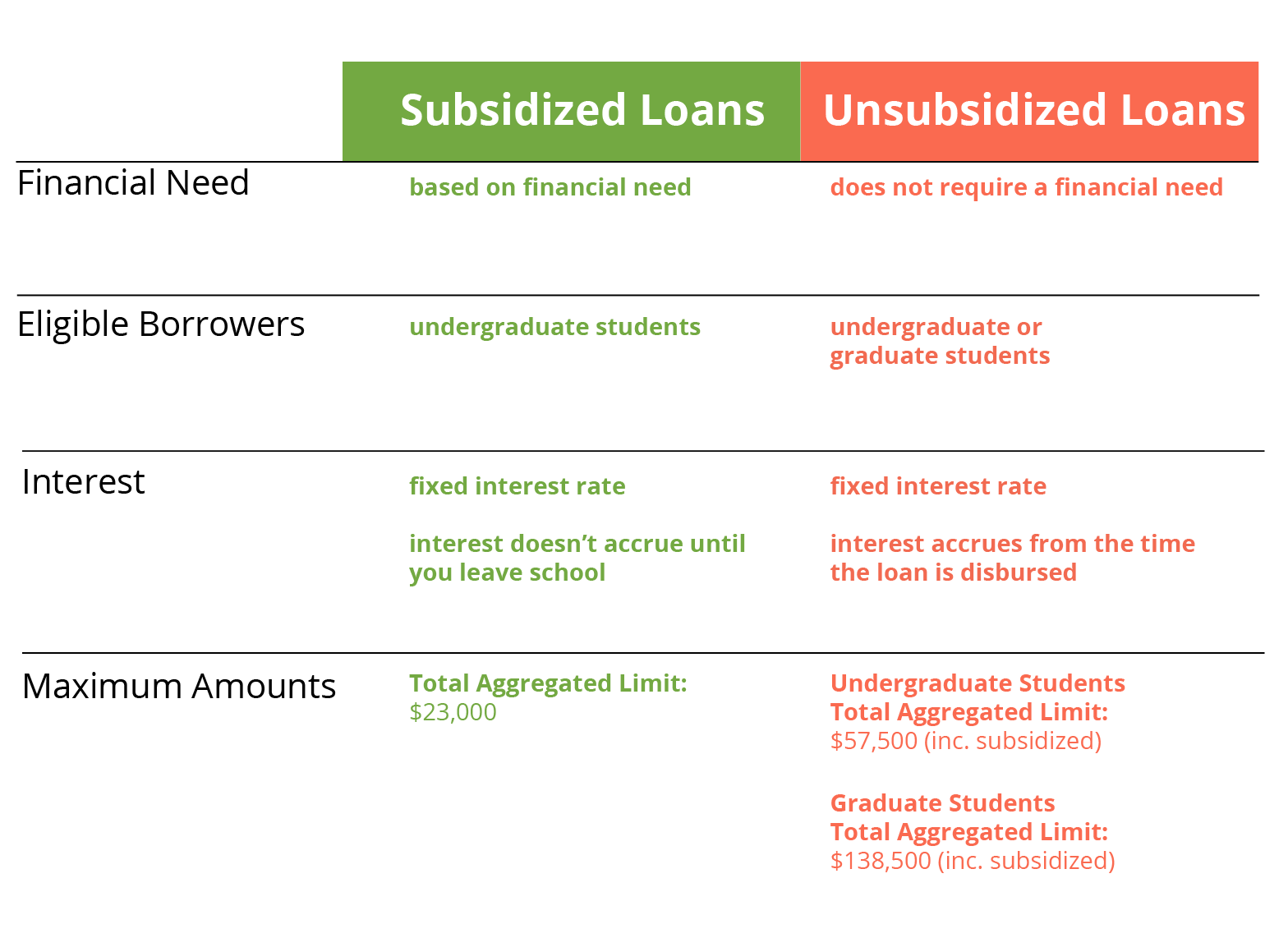

Most federal student loan borrowers receive both subsidized student loans and unsubsidized loans. What is the difference?

Subsidized student loans have an advantage over unsubsidized student loans because they do not accrue interest while the borrower is still in school.

What does “subsidized” mean?

The Department of Education pays the interest on some federal loans while the borrower is attending school or under deferment. The interest payments are “subsidized” by the government.

Is it better to have subsidized student loans or unsubsidized student loans?

It’s better to have subsidized loans. A subsidized student loan doesn’t accrue interest until the borrower has entered their repayment period. An unsubsidized student loan accrues interest while the borrower is still attending school. In both cases, the borrower doesn’t have to make any payments until they leave school and enter their repayment period. However, the unsubsidized loan balances will be significantly higher because they had years to accrue interest.

Borrowers could save money on both subsidized and unsubsidized loans by making payments while still in school. Both plans have similar if not identical fixed interest rates, but both loans benefit by making early payments.

Why are some student loans subsidized and others are not?

Subsidized loans are based on financial need while unsubsidized loans are not constrained to a particular group of borrowers. First-year dependent undergraduate college students are eligible to receive up to $3,500 in subsidized loans of their $5,500 federal financial aid package. However financial aid packages vary from borrower to borrower and school to school.

Repaying Both Unsubsidized and Subsidized Student Loans Requires Help

No two people have the same student loan burden and are in the same financial situation. Depending on the size of your student loan debt and your current income level, you may qualify for an income-driven repayment plan that could lower you payments significantly.

The IonTuition counselors are ready and available to guide employees towards the best repayment plans for each person’s situation. Offer a voluntary benefit that truly helps your workers. Offer IonTuition.