Thanks to your college degree, you’ve secured a good job and you’re making student loan payments on time. You’re set! Or are you?

You can cruise along and make minimum payments, sticking to a standard repayment plan schedule, and have your student debt paid off in 10 years. But if you add a little extra to your monthly payment, you can save money and repay your student loan ahead of schedule.

The extra money you dedicate to your student loan payment goes towards the principal of your loan, reducing the loan amount, which, in turn, reduces the amount you get charged interest on. You may not realize it at first, but those small extra payments add up over time.

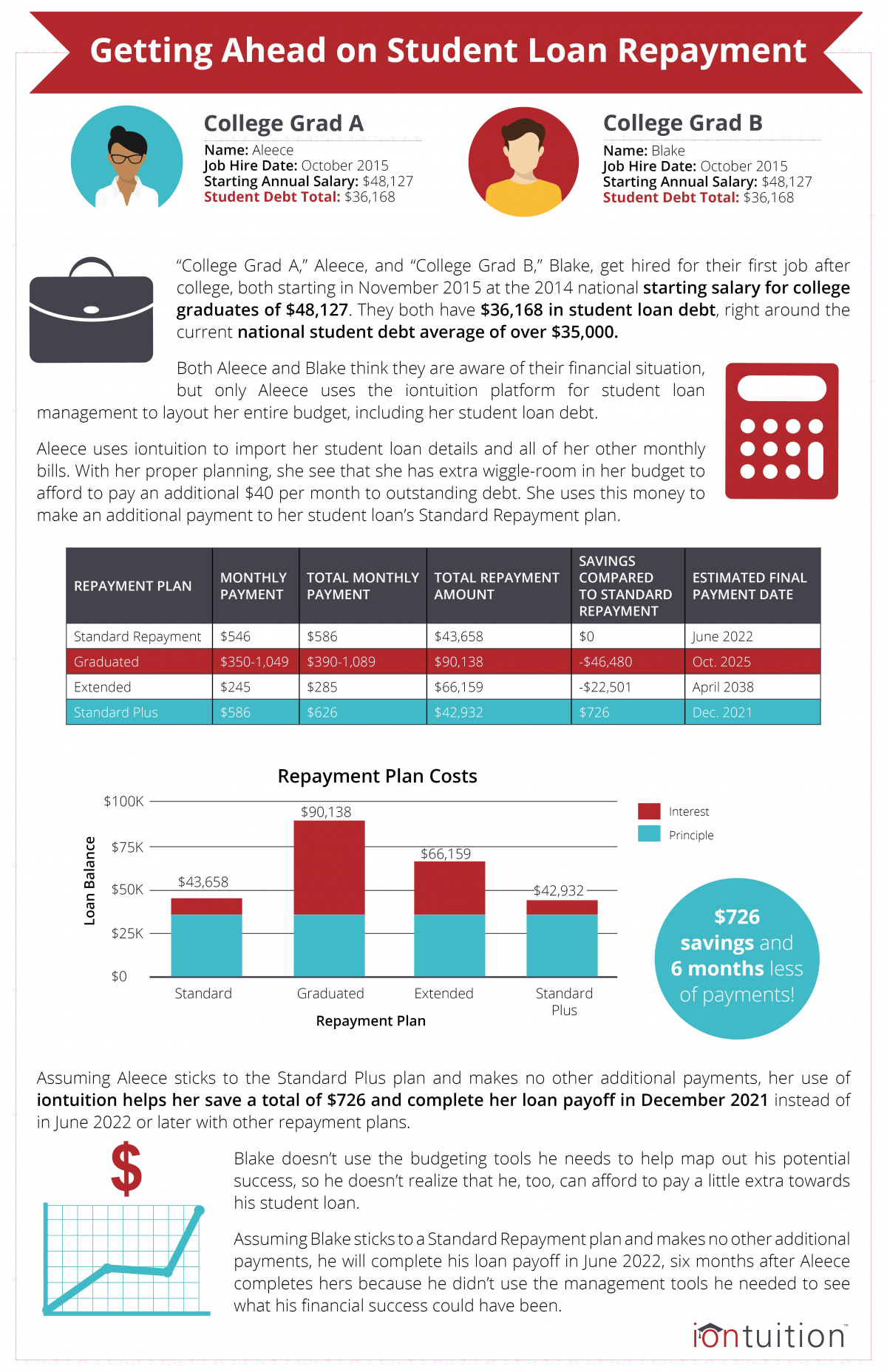

The scenario in the infographic below shows Aleece adding an extra $40 to her monthly student loan payment. That’s the equivalent to dinner and a movie. Not a huge sacrifice, right? But the benefit is much bigger.

By adding an extra $40 to her student loan payment, Aleece saves a total of almost $730 over the lifecycle of her loan. Plus, the loan is repaid six months ahead of schedule. That’s a vacation and the time to plan it! Who needs the neighborhood restaurant when you can dine in Cancun?

To see how you can save money on your student loans, sign up for an iontuition account here and use our student loan repayment calculator to optimize your repayment plan.

NOTE: If you received an email from iontuition, your school has provided you with a free iontuition account. Activate your account or log in now to see your loan balance.

NOTE: If you received an email from iontuition, your school has provided you with a free iontuition account. Activate your account or log in now to see your loan balance.