It’s no secret that college tuition can be expensive: room and board, textbooks, and transportation are all expenses that contribute to that overall cost. I’m sure you have either read or heard about students who graduate with an extremely large amount of student debt. Unfortunately, those student loans can quickly turn into a burden and put a damper on an individual’s personal finances. My goal is to help you be successful with your financial endeavors, and I saw this as a perfect opportunity to update this blog post and share 3 things college students should do before getting a job.

1. Evaluate college degrees with the best return of investment

Before committing to a career, evaluate the return of investment on the college degree you intend on earning. ROI is something that should factor into your college and degree choice. Taking on a substantial amount of debt to major in, and later pursue, a career in a dying industry is not the best idea. I am a huge supporter of following your dreams, but when those dreams don’t translate into realistic life plans, it is quite likely that they won’t pay off in the end. Your education is an investment and with any investment, you want something more in return. This is something you want to consider before you begin working, because if your education investment isn’t going to pay off, you won’t find yourself pursuing your dreams. You will find yourself taking any job to pay for your student loans. Do you research and find the right certificate program or degree for you.

I currently go to a community college where I am working towards completing my Gen Ed classes. With only a semester left, I have been looking at schools with the intent of furthering my education. One tool I use and find very helpful is ionMatch.

ionMatch compiles data from multiple sources to bring you a powerful tool for selecting the right university to continue your studies. Instead of having to search the Internet for the ‘perfect college,’ ionMatch simplifies the process by incorporating admission data to let you know which schools best match your profile. You can then compare these schools across a variety of criteria, including graduation rate and average cost per student. The best part is that you can compare potential salaries for different majors across your selected colleges. This helps guide you to the best potential return of your education investment, make the most informed decision possible, and see the clearest picture of your future. After considering the ROI of your college choice and degree, you can begin to figure out how you will fund your education.

2. Organize key components: resume, portfolio, and social media

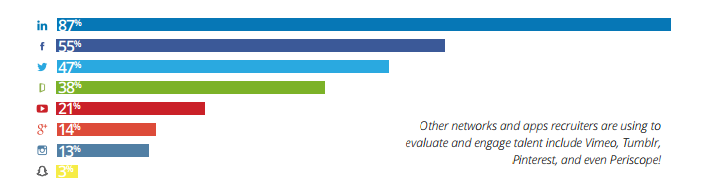

Even if you do have a job, it is always helpful to organize and update your resume, portfolio, and social media. As technology continues to advance, the workforce and hiring process does as well. According to Jobvite’s 2015 Recruiter Nation Survey, 92% of recruiters use social media in the recruiting process.

This image, taken from the survey, reveals that 87% of employers will look at your LinkedIn profile upon hiring, followed by the 55% that will look at your Facebook, and 47% will check Twitter.

This is why it is crucial to be conscious of your social media footprint and understand that what you post represents YOU.

3. Find a job that fits you as a student

When finding a job as a student, it is important to compare the hours you to go class to the hours you have free. After you include time to do homework and study, estimate how much free time you have that will work with your schedule. At this point, I would encourage you to create a reasonable goal of how much money you want to make and what portion of it will go towards paying for your education. Goals are important because they force us to push ourselves to reach what we want. With that being said, it is important to find a job that will still allow you be successful in school. Many students choose to do a work-study, which is a job provided to you through the school that allows you to earn money and pay off college expenses. The key to having a job and going to school is flexibility. Something I did was find a part-time job that was closely related to my major. My reasoning behind this was that I would gaining valuable knowledge that wouldn’t only help me at work, but also at school.

If you are having trouble finding a job, ask your college counselor for help. A lot of times, colleges have career centers that are dedicated to helping students find a job. Another thing to consider and ask your counselor about is internships. Many companies pair up with colleges to provide students an internship. You never know, an internship could potentially guarantee you a job after college.

Overall, the best way to succeed when working and going to school is to envision your end goal. It is important to think about where you see yourself after college and what career you intend on working in. From that point, you do what is necessary to achieve that goal. Having a job while in school pushes you towards success: it teaches you responsibility, real-life issues, and on-the-job skills. You will be able to take the skills you learned and apply it to different aspects of your life.

As Blogger and budget aficionado, Tara K. helps students across the country enhance their knowledge about money management and everyday life. She is constantly looking for new ideas to transform into great advice for you. Pursuing a journalism major, Tara K. has a passion for the art of inquiry, which is conveyed through her writing.