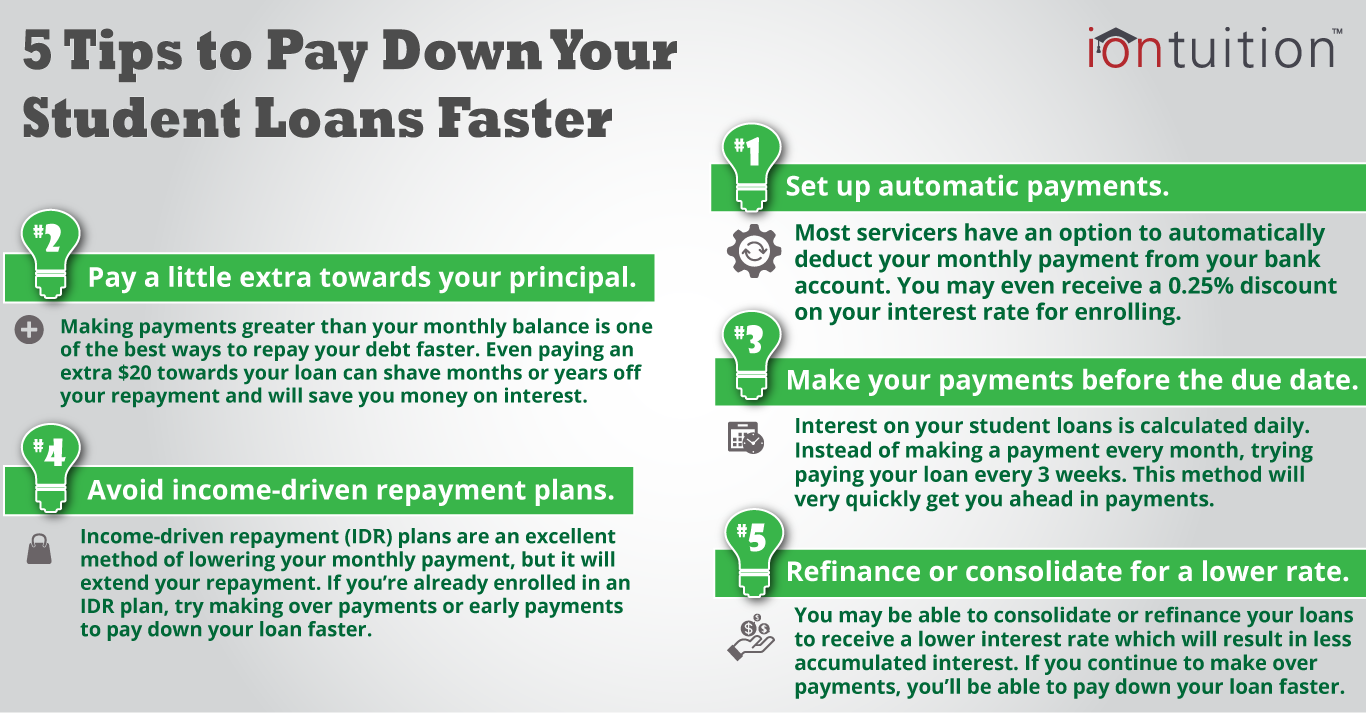

1. Set up automatic payments. Most servicers have an option to automatically deduct your monthly payment from your bank account. You may even receive a 0.25% discount on your interest rate for enrolling.

2. Pay a little extra towards your principal. Making payments greater than your monthly balance is one of the best ways to repay your debt faster. Even paying an extra $20 towards your loan can shave months or years off your repayment and will save you money on interest.

3. Make your payments before the due date. Interest on your student loans is calculated daily. Instead of making a payment every month, trying paying your loan every 3 weeks. This method will very quickly get you ahead in payments.

4. Avoid income-driven repayment plans. Income-driven repayment (IDR) plans are an excellent method of lowering your monthly payment, but it will extend your repayment. If you’re already enrolled in an IDR plan, try making over payments or early payments to pay down your loan faster.

5. Refinance or consolidate for a lower rate. You may be able to consolidate or refinance your loans to receive a lower interest rate which will result in less accumulated interest. If you continue to make over payments, you’ll be able to pay down your loan faster.