The Consumer Financial Protection Bureau (CFPB) recently reported that 90% of the highest risk student loan borrowers were not enrolled in an affordable repayment plan. Millions of federal student loan borrowers can lower their monthly payments by enrolling in an income driven repayment (IDR) plan. The same CFPB report found that borrowers who did not enroll in IDR after defaulting were five times more likely to re-default.

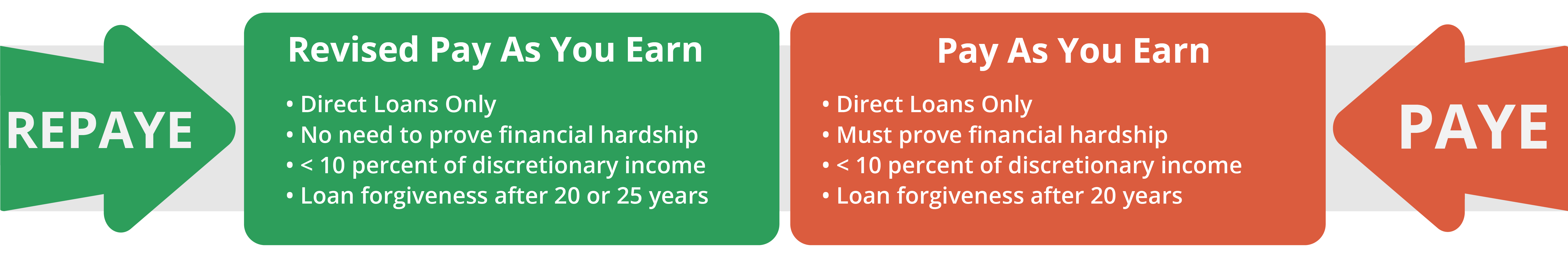

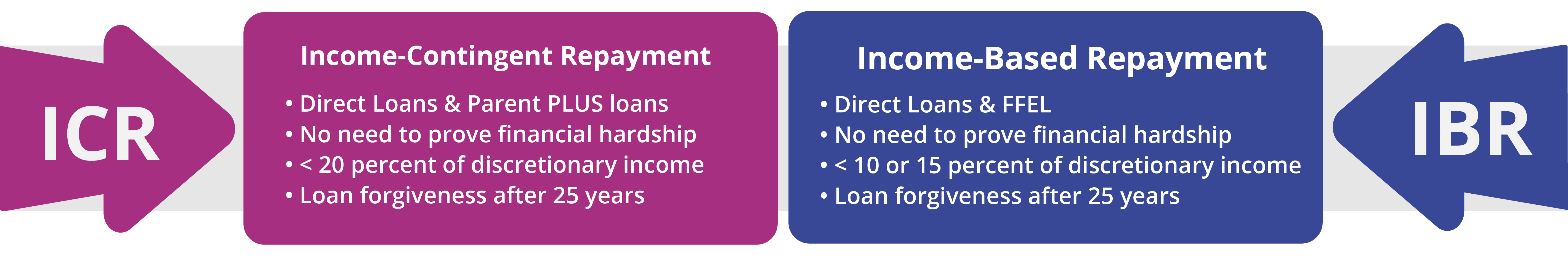

IDR determines your student loan payment based on a percentage of your discretionary income. Different plans are available for different types of borrowers. A borrower who is single, childless, and only borrowed for undergraduate studies will likely qualify for a different plan than a borrower who is married with graduate school loans. Also, eligibility for some plans may vary if loans have been consolidated.

Due to the complexity of these repayment plans, it is important to discuss IDR with a knowledgeable student loan expert such as an IonTuition counselor before enrolling in a new plan.

[CP_CALCULATED_FIELDS id=”6″]

IonTuition users can use the “Plan My Payments” function on their accounts to be matched with an IDR plan according to their income, state, family size, and tax-filing status. After being matched, our counselors can walk you through how the IDR plan works and even connect you to your loan servicer.

Currently there are four IDR plans to choose from: