If you graduated in May or June, then you are approaching the end of your grace period. Starting next month, you will need to start paying back your student loans. You should have started preparing for this moment when you left school, but if not, you still have time to get ready. Here’s what you need to do:

Make a budget

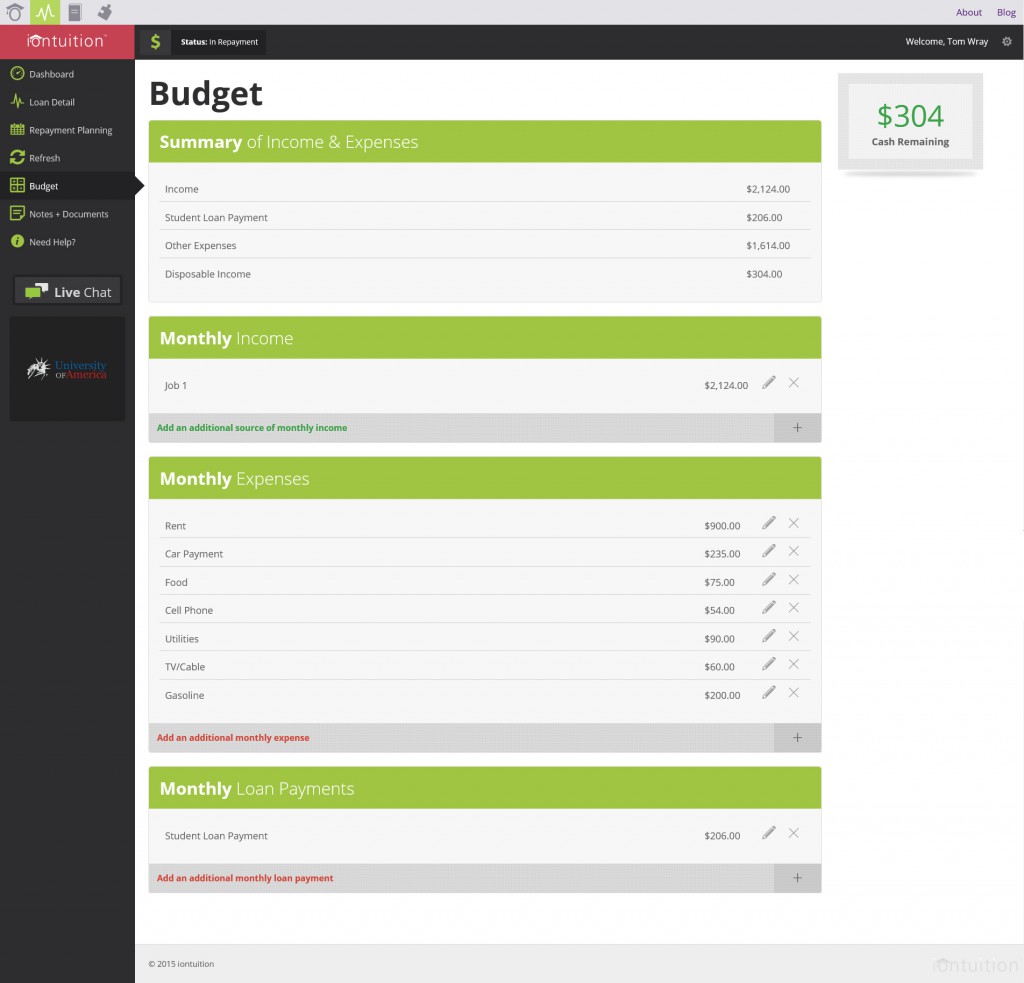

You need to know how much you can pay toward your loans each month before you do anything else. That will give you a starting point to decide what plans you qualify for and what plan will work the best for your lifestyle and financial situation. You can use the budget tools in iontuition’s ionManage to plan your budget and have it ready when you move on to the next steps.

Look at your options

You have options on how to pay back your loans, so make sure to review each payment plan carefully. On the standard repayment plan, your payment will be at a set amount each month and your loan will be paid off in ten years. Your income is not considered for the standard repayment plan – just the amount of the loans and the date they should be paid off. Other payment plans, such as income-based, income-sensitive, and graduated, all take your income into account but can take ten to 20 years to pay off. The standard payment will save you money in the long run since it pays down the principal faster and saves on interest. But the other plans have payments that can fit into your budget much more easily at the beginning. Use ionManage’s loan calculators to find out what plan will work best for you, and if you need help deciding, contact one of our expert loan counselors for help.

Select your plan

You must choose a payment plan before the end of your grace period. Otherwise, you’ll be put into the standard repayment plan. Making your selection now, before the grace period ends, will prevent any surprise big bills and will help you avoid missing a payment or underpaying because you couldn’t afford the full payment. Better a decision now than a hassle later.

Call your loan servicer

The loan servicer is who you’ll be making student loan payments to. By now, they have probably sent you letters reminding you of the grace period ending. If you don’t know who your loan servicer is, check out ionManage through your iontuition account. You’ll find the loan servicer contact information in the student loan management dashboard. Call them to set up your payment plan. Plus, it’s a great time to make sure they have your current contact information so you can stay informed.

The end of the grace period and the start of repayment doesn’t have to be difficult. By planning, researching, and being proactive, your student loan repayment can be relatively painless. But it is up to you to make sure it gets off to a good start.

![]()

Tom Wray is all about the research, getting it right, and making it relevant. He’s got solid journalistic experience in all forms of content delivery – and he’s got his keyboard humming with what’s up and important for students, college admins, parents, employers and news junkies. Follow @iontuition on Twitter for more content like this!