Millions of Americans have taken out student loans to afford college for themselves or their dependents. National statistics reveal how student loans became a crippling economic concern.

Employers have an opportunity to offer a student loan repayment benefit that can mitigate the American student debt crisis — as well improve the financial wellbeing of their employees.

National Student Loan Statistics

Student Loan Hero compiled some student loan statistics about the 2017-2018 student loan situation. Much of these data and student loan statistics were compiled by the Federal Reserve, the Wall Street Journal, and other financial gurus and entities.

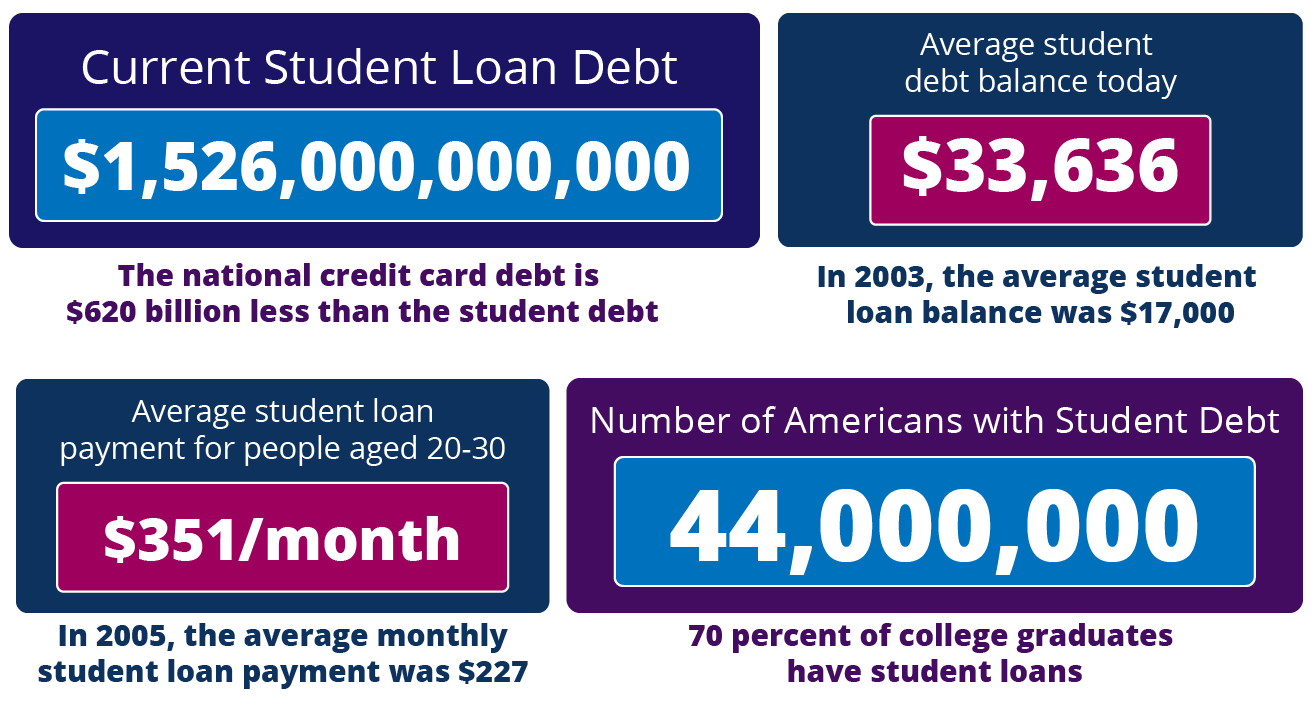

- Current student loan debt – $1.53 trillion and climbing

- Number of Americans with student debt – 44 million

- Average student debt balance – $33,636

- In 2003, the average student loan balance was $17,000

- The national credit card debt is $620 billion less than the student debt

- Average student loan payment – $351/month for persons aged 20-30

- In 2005, the average monthly student loan payment was $227

- As reported by CNBC, 70 percent of college graduates have taken out (and owe a significant amount on) loans.

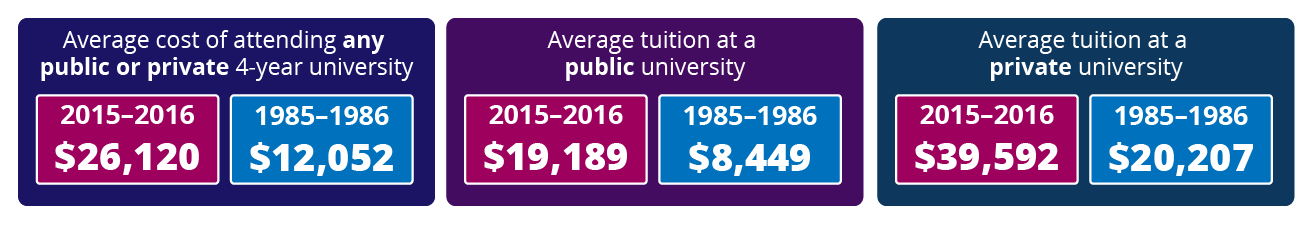

Tuition Statistics

The amount of student loan debt has risen exponentially; the same can be said for the rates of tuition. The National Center for Education Statistics has some key research to help provide further insight:

The Cost of Living Impact

- The average cost of attending any public or private 4-year university is $26,120.

- In 1985-86, the cost of a 4-year university education was $12,052.

- Average tuition at a public university – $19,189

- In 1985-86, the average tuition at a public university was $8,449

- Average tuition at a private university – $39,529

- In 1985-86, the average tuition at a private university was $20,207

The majority of the national student debt is held by Millennials, currently in their mid-20’s and early 30’s. Business Insider reports that wages have significantly increased since the 1970s, which is necessary, but may not have increased enough: “Rent, home prices, and college tuition have all increased faster than incomes in the US.”

While some costs of living are manageable, the article reported that “the most important parts of the economy are getting more expensive, creating an even bigger financial burden for Millennials to shoulder.” The economy grows when college graduates move out on their own, get married, buy a home, and start a family. Employers can help college graduates manage their student debt and achieve those milestones that boost the economy by offering student loan repayment benefits.

There are many reasons why offering student loan repayment benefits is a must as an employer. IonTuition offers management tools and employee benefits for colleges, employers, and brokers, and truly anyone else who is in need of an excellent employee perks program. We have a number of toolkits such as IonManage, IonPay, IonMatch, IonLearn, and IonPerks, all of which are designed to make employee benefits easily accessible, understandable, and exceptional. Get started with our team today.