Millennials Are Delaying Home Buying Because of their Student Loans

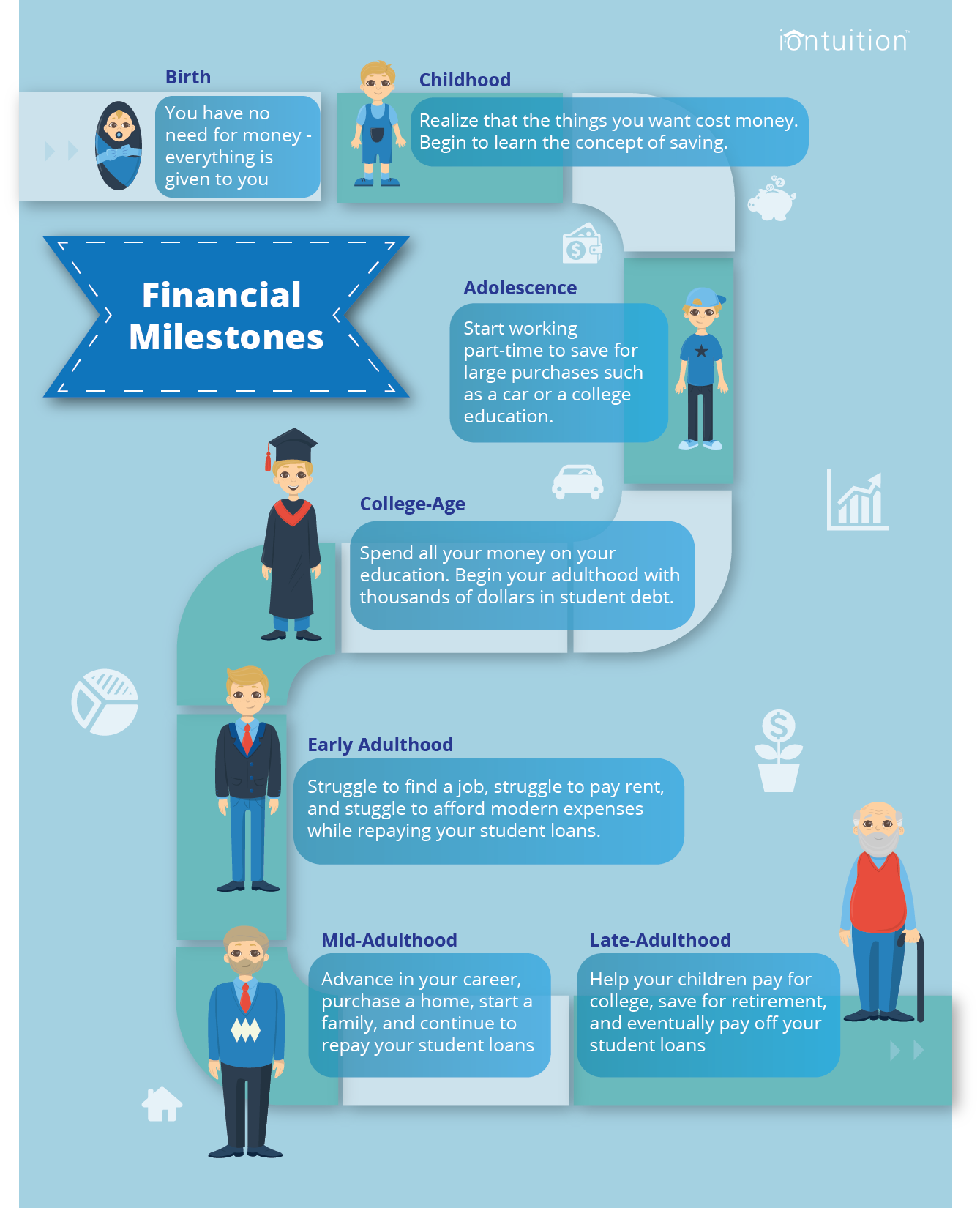

A study last October by the National Association of Realtors and the American Student Assistance agency found that millennials are delaying home buying by approximately seven years. Millennials carry an average student loan debt of approximately $30,000, which is close to their median income. Mortgage lenders typically have a maximum debt-to-income ratio. A high monthly student loan payment can push a person’s ratio over the maximum of 43 percent recommended by mortgage lenders.

Millennials Are Delaying Marriage Because of their Student Loans

It isn’t only home buying that Millennials are putting off because of their debt. Over half of Millennials are unmarried, compared to only 17 percent of 20 and 30 year-olds in 1965. Student loan debt doesn’t prohibit a person from getting married and there are a number of other reasons why Millennials are not getting married that are financially unrelated, however 21 percent of Millennials reported putting off marriage as a result of their student loans.

Millennials Will Likely Retire Later Because of their Student Loans

Student loan debt is a long-term burden. With extended repayment plans allowing borrowers 25 years to pay off their loans, millions of borrowers are planning to carry their loans well into their 40’s. If you consider deferment options and additional student loans to complete graduate school, borrowers could potentially be paying student loans up to or into retirement.

Nerdwallet reported that recent graduates won’t likely retire until their mid-70’s. Making a monthly student loan payment for years severely limits a person’s capacity to save for the future. Millions of college graduates start their lives massively in-debt and many of them will be unable to enjoy a long retirement.

Now is the Time for Employers to Help Repay their Employees Student Loans

Millennials are more likely to accept a job if the company offers student loan repayment assistance. Businesses that offer their employees student loan benefits will attract better talent and more easily retain their current staff. Student loan repayment assistance is just as important to a person’s financial wellness as a 401(k) plan.