Artificial intelligence has a role in higher education, but it won’t help analyze or predict which student loan borrowers will become delinquent or default. AI will not be able to predict actions colleges and universities can take to alleviate the issue. The three-and-a-half-year payment pause followed by a “soft” year-long repayment start has reset any delinquency and student loan default predictions.

Student Loan Delinquency Has Already Increased by 40 or 50 Percent

The majority of student loan borrowers have not made payments since the soft restart in October 2023 because they don’t have to. Servicers are actually refunding payments that borrowers made during the COVID-19 pause.

The “Hard” Repayment Begins in October 2024

27 million borrowers on top of 3 million new borrowers must begin payments beginning in October 2024. Student loan borrowers will no longer be given a pass for missed payments and Servicers will be held accountable. Since October 2023, Federal Student Aid (FSA) has penalized Servicers to the tune of $12 million for failing to meet their service level agreements.

Expect All-Time High Student Loan Default Rates

According to the Liberty Street Economics report of students who left college in 2010 and 2011, 28 percent defaulted on their student loans within five years, compared to 19 percent of those who left school in 2005 and 2005. Note that student debt increased by 170 percent between 2006 and 2017.

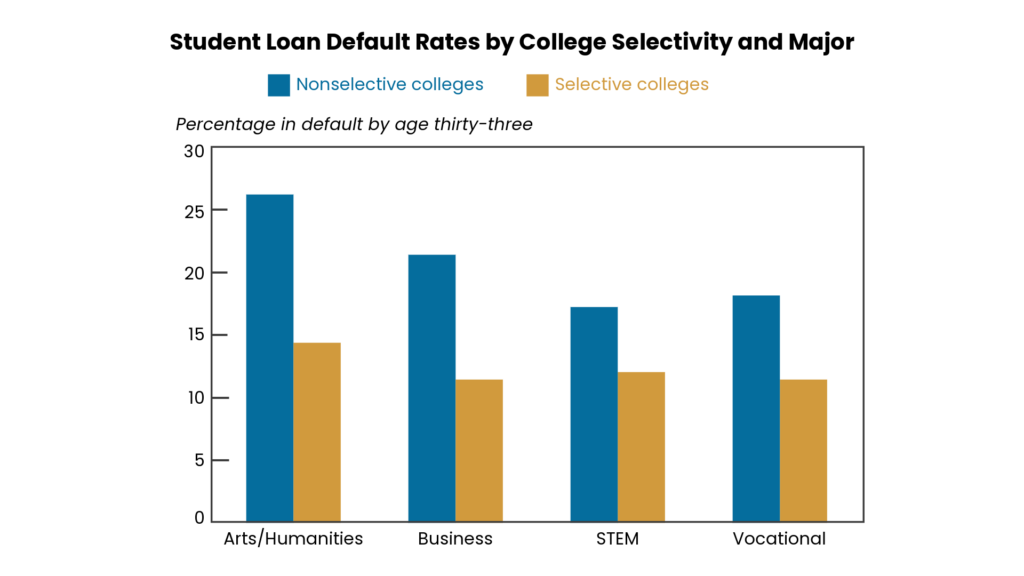

The table above from 2017 shows the percentage of student loan default by age 33 in various disciplines at selective versus non-selective colleges. Borrowers at nonselective colleges are more likely to default.

We predict the default rate will increase to an all-time high by over 40 percent. The national average will be between 19-22 percent and rates at nonselective colleges, 2-year public, not-for-profits, and for-profit institutions will double from the 2017 numbers.

Colleges Can’t Depend on Federal Servicers

Colleges need to take matters into their own hands and not rely on federal servicing. Financial penalties are being proposed by a Republican-sponsored bill to hold all colleges and universities responsible when loans default. This proposal may get enough bipartisan support to pass.

What can institutions of higher education do? There are no predictive analytics, experience in post-COVID issues, or removing the confusion and noise from Congressional leaders and Presidential candidates touting forgiveness and cancellation. There are only best practices in student loan default aversion. And companies like IonTuition perfecting them.