When you’re in the desirable situation of having a extra money in your monthly budget, what do you do with those additional funds? Save it? Use it to pay down student debt? Invest it? It’s not always an obvious decision. If you save it, then your money isn’t working for you. If you use it to pay down student debt, then you aren’t growing your savings. If you invest it, the interest on your debt keeps accumulating.

Let’s Do the Math

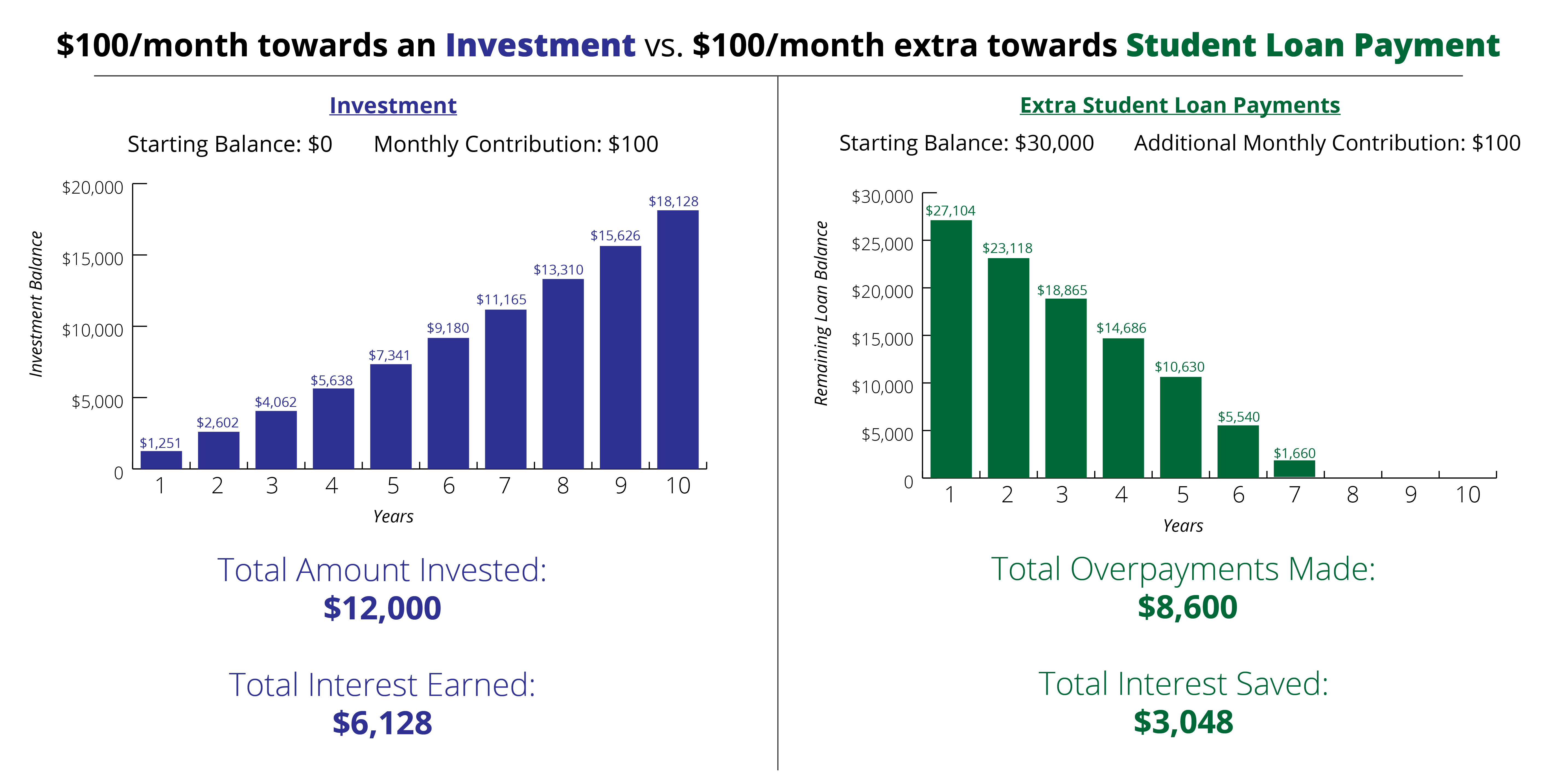

Under a 10-year standard repayment plan on a student loan balance of $30,000 with 6% interest, the borrower accumulates nearly $10,000 in interest over the life of the loan. Paying an additional $100 per month will save over $3,000 in interest, as well as repaying the loan nearly 3 years early.

Now, let’s compare that to investing $100 per month. Under a 10-year conservative investment plan in the stock market (assuming standard returns from index funds), a person starting with $0 and investing $100 per month could potentially earn over $6,000 in interest over a period of 10 years. That’s long-term investing across conservative, diversified index funds.

If a person had to choose between investing $100 or overpaying $100 towards debt, the math supports investing. The interest earned from investing will actually cover nearly all of the interest fees from a student loan. Conventional financial advice also supports investing your money instead of paying down low-interest debt, especially when you’re young. 10 years of investment is good, but 20 years of consistent investing has substantially better returns.

Realistically Speaking…

Everyone’s financial situation is unique. Most likely if you’ve been carrying student debt for many years, you’re probably not in a position to invest in the stock market. But the data above show that conservative investing in mutual funds is a fairly safe bet. Historically speaking, the stock market will grant you a significant return over a time period of 10 years.

What to do?

According to most financial advisers, the best options between deciding to save, invest, or pay down debt is do a little bit of each.

- Save: It’s important to have some money set aside, but be careful how much. If you have too little in savings, you run the risk of not having money in case of an emergency. If you have too much in savings, then you aren’t using that money to make more.

- Invest: Adding as little as $10 per month towards a retirement account such as an IRA will pay off in the long run. Compound interest works in your benefit when it has enough time to compound. Start investing early in your career so your money has more time to grow.

- Pay down student debt: There are number of ways to pay down student debt faster, but good practice is to pay down loans with higher interest rates first. Sending extra money towards the principal each month can help you get ahead in your payments, save money on interest, and repay your loan sooner.

Employer Contributions

If you employer offers to match extra payments towards your student loans, even better! IonTuition can help companies set up a matching contribution program that can accelerate repayment and save thousands in interest. Contact us today to learn how easy it is to offer student loan benefits to your employees.