EMPLOYER STUDENT LOAN REPAYMENT BENEFITS

How about a platform that actually pays off?

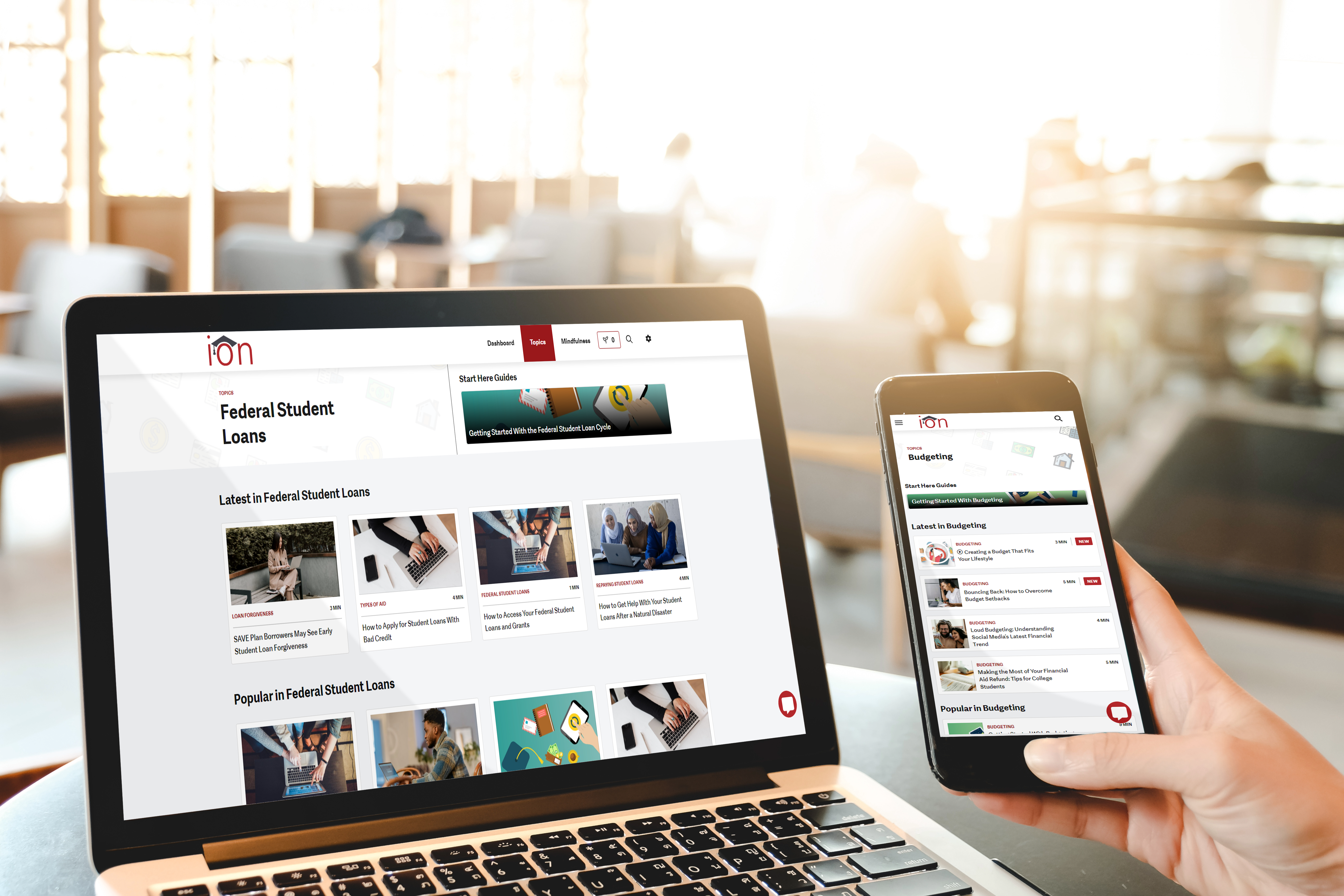

Self-Service Repayment Tools

Income-Driven Repayment Plans

Save time connecting to servicers and save money on your monthly payments by applying for an income-driven repayment plan directly through the ION portal.

Public Service Loan Forgiveness Assistance

for non-profit organizations

Help your employees apply and certify for the Public Service Loan Forgiveness program.

Live Support from Expert Counselors

ION users can connect to an expert live student loan counselor via phone or webchat to help with repayment questions or to conference call with their servicer. We’re here to help users when they need us.

Financial Literacy Program

Help your employees reach their financial goals one step at a time

- Assess finances and receive recommended tools, content, and courses to reach financial goals

- Build financial skills every month as new content is added

- Learn how to plan for retirement while repaying student loan debt or planning to send your kids to college

NO-WORRY REPAYMENT

Employees make, update, and change repayment plans entirely through Presto in the IonTuition platform. No phone calls. No wait times.

![]()

ACCOUNTS FOR THE WHOLE FAMILY

COUNSELING BY REPAYMENT SPECIALISTS

Employees can call or chat with expert student loan counselors who can connect with their servicer to set up new repayment plans today.

FINANCIAL LITERACY PROGRAM

Employees improve their financial literacy and learn to save for retirement and plan for college while repaying their student loan debt

The Best Organizations Choose IonTuition