Natural Disaster Relief for Student Loan Borrowers

Disaster relief for student loan borrowers is currently available for individuals impacted by FEMA-designated disasters, including Hurricane Helene and Hurricane Milton. If you’re having trouble reaching your servicer or your school’s financial aid office,...

On-Ramp Ends and Biden’s “Plan B” Student Debt Relief Plan Blocked (Again)

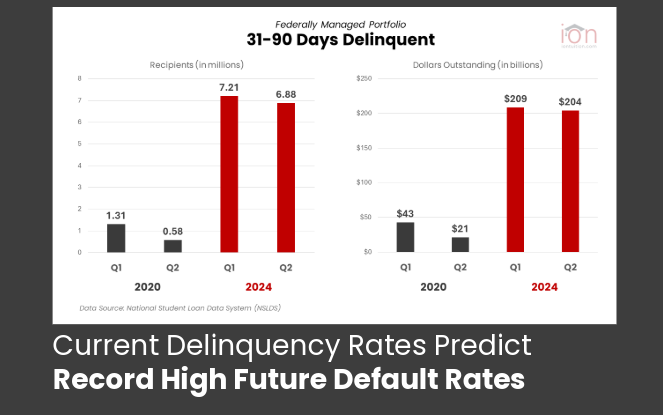

The federal student loan “on-ramp” period officially ended at midnight on September 30. This on-ramp gave borrowers 12 months to adjust to making their student loan payments without negative consequences for missed payments. Many Student Loan Borrowers Did...

Student Debt Relief Unlikely Before Election

The temporary restraining order (TRO) blocking the Biden administration’s student debt relief plan has been extended by a federal judge this week. The original order was issued on September 5th following a lawsuit filed by seven GOP-led states attempting to...

7 Million Student Loan Borrowers Unable or Unwilling to Make Payments During the On-Ramp

12-Month On-Ramp for Federal Student Loans to Expire Soon The Department of Education’s 12-month on-ramp for federal student loans expires September 30th. The on-ramp prevents the worst consequences of missed, late, or partial payments, including negative credit...