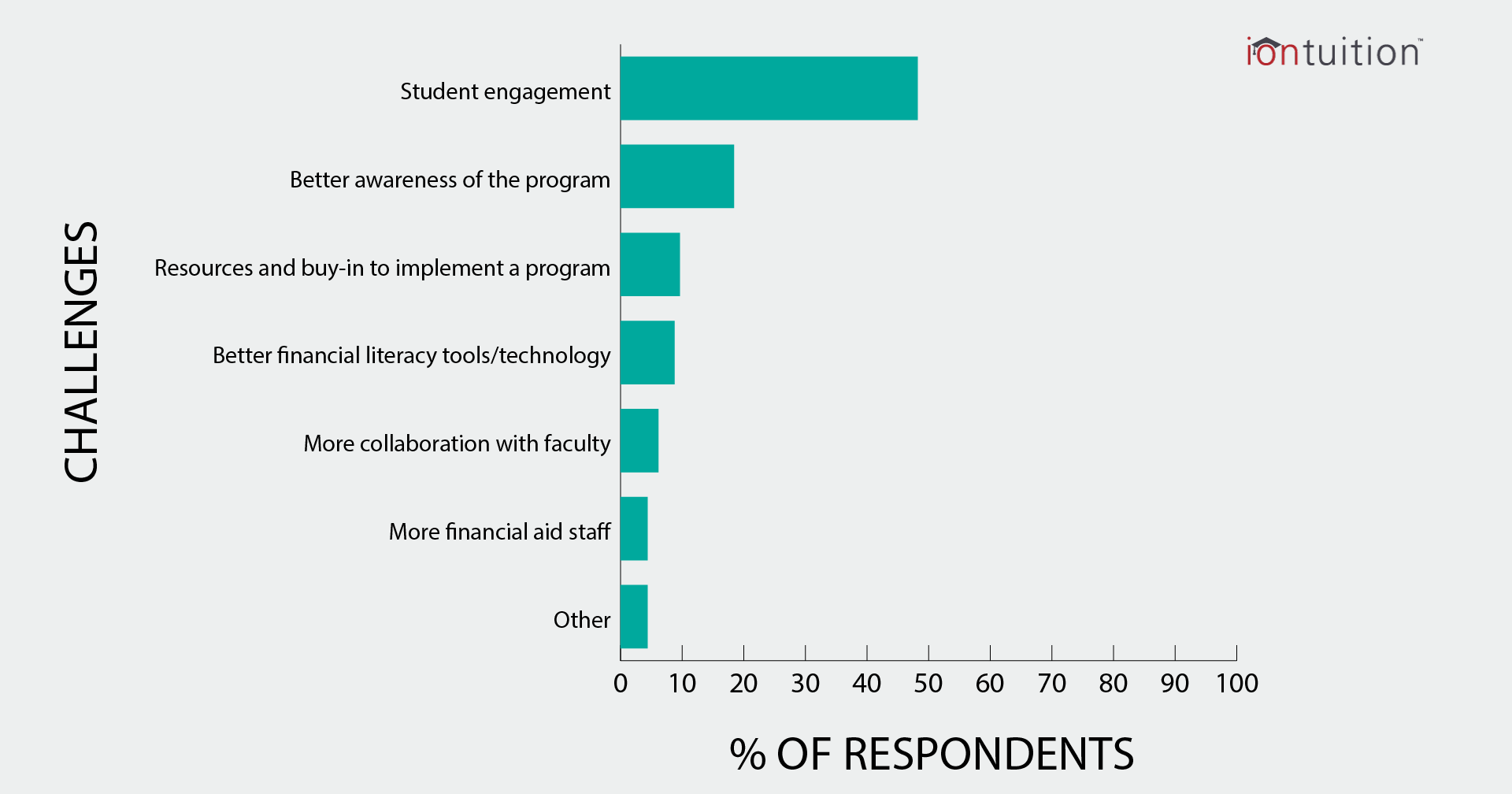

No matter how much effort you put into creating a rock star financial literacy program, getting students to engage with it can be a challenge. We have the stats to prove it. Our survey of more than 100 financial aid professionals found that the majority of respondents rank student engagement as their most pressing financial literacy challenge, followed by better awareness of the program.

There’s no silver bullet for solving the student engagement challenge. A school with mostly traditional students will need to approach the challenge differently from a school with mostly online students. However, there are some tips that can be applied universally. Here are three tips we have found work for nearly every school.

Think like an advertiser

In the words of Mad Men’s famous Don Draper, “If you don’t like what is being said, change the conversation.” What can you do to change the way students think about financial literacy? Maybe there’s a local food joint you can partner with (free pizza anybody?), or perhaps you can encourage the campus mascot to spend some time around campus handing out free prizes to students who can answer financial questions correctly. Have you tried engaging your students on Twitter or Facebook? How about talking to the Resident Assistants to hold financial literacy-themed events in the dorms?

There are loads of different things you can try! Put on your creativity cap and brainstorm with your colleagues.

If you’re not in the mood to be inspired right now, there are two concrete things you can always count on to increase student engagement in your financial literacy program.

Bring the message directly to the students

No matter what type of school you work for, you will need to go beyond dated, “traditional” outreach channels to improve student engagement. Using a multi-channel approach that includes modern communication technology is the top way to reach today’s students and increase participation.

A recent survey by the National Council for Higher Education Resources (NCHER) found that the traditional staples of most outreach programs, like calls to landlines and physical mailings, simply aren’t the best ways to reach students anymore. More than 90 percent of student loan borrowers aged 18-24 have a cell phone. Barely 15 percent have a landline phone. Most importantly, more than 45 percent of student loan borrowers prefer a cell phone call or text message over any other type of contact when communicating about their student loans.

Despite the fact that 80 percent of financial aid professionals agreed students would benefit from on-demand student loan counseling, web chat and mobile are the least used communication channels today according to the 2016 Financial Literacy Trends on Campus Survey. Given that students frequently (always) have their cell phones and computers handy, web chat and mobile are the most logical channels to use for any on-demand student loan counseling initiatives. These channels are low-cost options that bridge the gap between technology, one-on-one counseling, and on-demand information. With only nine percent of survey respondents reporting that they use either web chat or mobile, this is clearly an underutilized resource.

Look beyond graduation

Perhaps one of the best ways to increase student engagement is to change your mind set about who is considered a “student.” Rather than defining “student” as someone who is enrolled at your school, broaden your definition to include students who have recently graduated or left school. Even more so than current students, this group could be more receptive to your message because they are hungry for financial advice. Schools are judged by the success of their students, graduates and non-graduates alike, but financial aid professionals report that their communication effectiveness drops by 25 percent after students leave school.

Have a team reach out to students during their grace period. Educate students on their student loan repayment options and make sure they understand their repayment responsibilities so they do not become delinquent. If you don’t have the resources to create a team like that, look into technology solutions (we’re fond of iontuition) that allow students to web chat with student loan counselors for free. This takes the burden off of your school and gives your students a resource for ongoing support.

If you have any creative ideas for promoting student engagement on your campus, we’d love to hear them. Tweet to us at @iontuition.