I really never thought the day would come where I would tell people to opt for generic brands instead of popular brand names. As I child, I would always get so angry with my mom when she would buy the ‘box store brand’ rather than a more ‘cooler’ popular name brand. But… the second I had to start buying things on my own? I had a change of heart!

Believe me, I love the brand Ice Mountain water bottles more than the next person, but sometimes buying elite names when you’re on a budget really isn’t the best answer. When I go to a store that offers generic brands, I would ask myself: If I buy generic will I really know the difference? Will I appreciate the quality of this non-generic item?

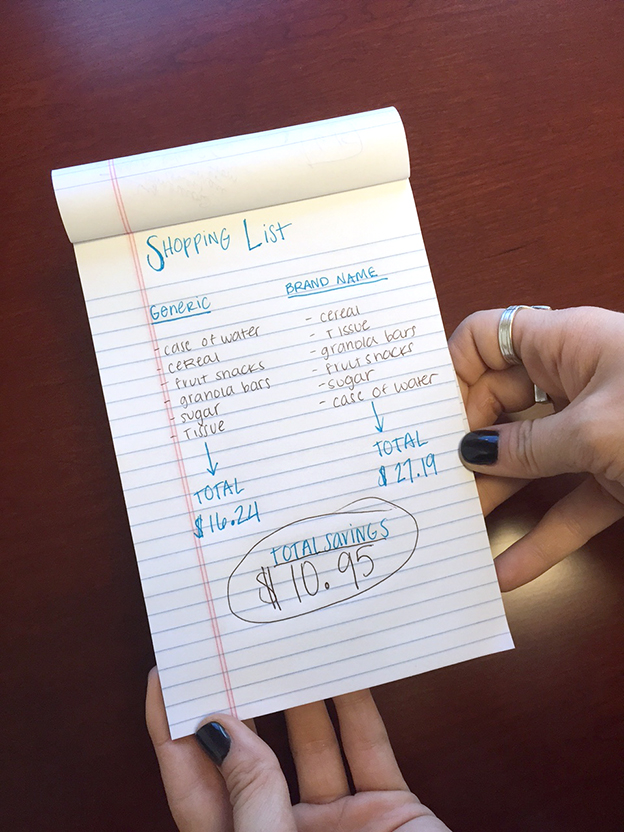

I frequently found myself saying no, because it’s true. Did you know that, in many cases, the same manufacturer makes both the generic and brand name product ─ meaning there is no difference at all (except for the price). So, I did a little experiment when I went to my favorite big box store yesterday to show you how much you’d save buying solely generic products.

As a college student, if you come across any opportunity that allows you to save money ─ take full advantage of it (I promise in the end you will be happy you did). Another helpful tip I have is to create a budget and actually stick to it. You can use the iontuition™ budget feature located in the ionManage section. All you have to do is add in monthly expenses, income, and monthly loan payments, and then the amount of money you have left will be presented on the screen!

I always thought budgets were used by people like my parents, but when I actually started using one, I began to see how much money I was actually wasting as well as areas where I could save money. It’s easy to find yourself in debt, but if you adopt frugality and adjust your lifestyle choices just a little, finding yourself in a state of financial crisis will be way less likely!

Try my experiment. Write yourself a list before you go to the grocery store and compare prices between generic and popular brand names. You will see the savings right before your own eyes.

As Blogger and budget aficionado, Tara K. helps students across the country enhance their knowledge about money management and everyday life. She is constantly looking for new ideas to transform into great advice for you. Pursuing a journalism major, Tara K. has a passion for the art of inquiry, which is conveyed through her writing.