This is a topic I was really interested in writing about. Like you, wherever I am, I see people with an iPhone or Droid in hand. The ubiquitous smart phone! And, for those of you who pay for your phone bill each month, YOU know how expensive it is to own a smartphone.

In this post, I decided to bring attention to the expenses of a smartphone, especially for those of you who are in college. We can use my situation for the sake of this blog: My two sisters and I share 15 gigs of data each month, along with unlimited talk/text. For our shared package, we owe about $200/month, and that does not include the cost of our phones. And, add $60 dollars, per line fee, for three phones. The costs don’t stop there; we are also billed for insurance and data overages.

Data overages are really what tacks on a good amount each month. Yes, you are probably thinking 15 gigs of data divided by three people is a lot, but my sisters and I travel a lot and in those cases we have to use our GPS, which requires data. There are also times when we go somewhere and wifi isn’t offered, so we burn through the data.

Once we hit that 15 gig mark, we are charged an additional $15 dollars every time one of us goes over. As you can see, having a smart phone adds up. Student loans, room and board, tuition, books, food, entertainment, etc. are all additional things that college students have to pay for. Adding on a $150+ monthly bill each month probably isn’t the smartest way to utilize your smart phone.

SO, after doing some research, I found the best ways to reduce these costs.

The quickest way to rack up your phone bill is the data plan. Choose the lowest data plan possible and only use data when you truly need it. There are so many places that offer free wifi (there is even an app that can help you find it). When you’re not in an area with WiFi, shut your data off! Believe me I know that’s frustrating especially when you want to stream the latest music with Spotify, or even post videos of what you’re doing on Periscope, but I promise you those can wait.

The next way to minimize the costs of your smart phone is to minimize the ‘app shopping’ completely. This is something I struggle with because when I discover a cool new app, I usually buy it. Each time I do that it costs me about $2.99, but this usually happens multiple times a month. So I am now spending an additional $10.00 on apps. Right now $10 probably doesn’t seem like a lot but if you add that up, that is an additional $120 annually that you could have put towards something like your textbooks.

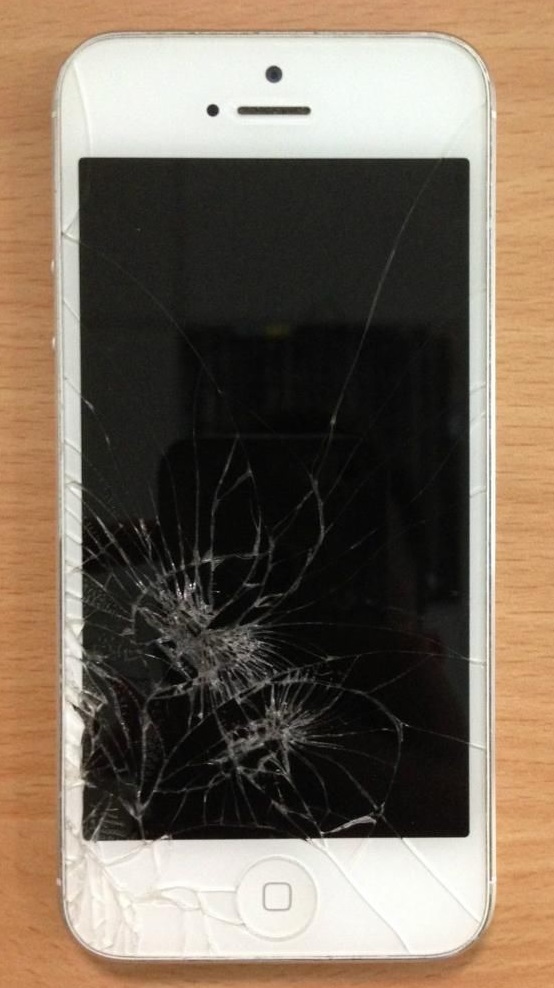

Do you ever carelessly use your phone? Drop it on the ground? Leave it at a friend’s house?

Well, don’t do that because that is the quickest way to burn through money. I have cracked my iPhone’s screen (the picture on the left is what my cracked iPhone looks like); I lost an iPhone, and water damaged another. All those careless things I did cost me money. The broken screen and button cost $75-100 each time to fix. Losing my phone and having to buy a new one cost probably close to $500, which is still tacked onto my bill today. Your smartphone is an expensive piece of equipment so take care of it. Keeping it in good shape not only keeps down the cost, but it also makes the phone last longer.

The ‘your iCloud storage is full’ message always pops up on my phone, and to be frank it bothers me. I looked into buying more storage but that is expensive, adding more money to my bill wasn’t an option. So, I found cloud-based storage for everything; pictures, documents, music. Not only is the service free, it freed up a decent amount of space on my phone and was a much better solution given my situation.

With what seems like a majority of smartphone owners today, I think ‘being smart about your smartphone’ is an important topic to discuss. Based on my experiences, I’m sure many more are not aware of how many real costs there are in owning a smartphone, or what costs we are mindlessly adding on.

Regardless, we should all be aware of how we are allocating our money. I have said this many times and I will say it again, life is about choices. We have the ability to choose what we prioritize. So, we can prioritize our smartphones, or we can prioritize a budget and balance the way we spend our money. That, let’s say, is smart.

As Blogger and budget aficionado, Tara K. helps students across the country enhance their knowledge about money management and everyday life. She is constantly looking for new ideas to transform into great advice for you. Pursuing a journalism major, Tara K. has a passion for the art of inquiry, which is conveyed through her writing.