Need some tips on how to eliminate your student loan debt as quickly as possible? Stay tuned for advice from Well Kept Wallet’s Deacon Hayes!

Deacon is a personal finance expert and the founder of Well Kept Wallet, a personal finance blog aimed at helping others achieve their financial goals in life. While also providing financial coaching and business consulting, Deacon is focused on helping you get from where you are to where you want to be when it comes to your career, money and lifestyle.

What it Takes to Eliminate Your Student Loan Debt Quickly

You’ve graduated from college and are now working to earn a decent income as opposed to racking up debt through student loans. In approximately six months, your student loan payments will begin.

With today’s average college graduate having to pay back over $35,000 in student loans, it’s easy to see how people become overwhelmed with student loan payments and simply pay the minimum due in order to minimize the financial burden.

However, there is a way to pay off your student loan debts faster so that you can start on the road to living life and building wealth. Here are six steps to getting your student loans debts paid off fast.

-

Put Together a Financial Game Plan

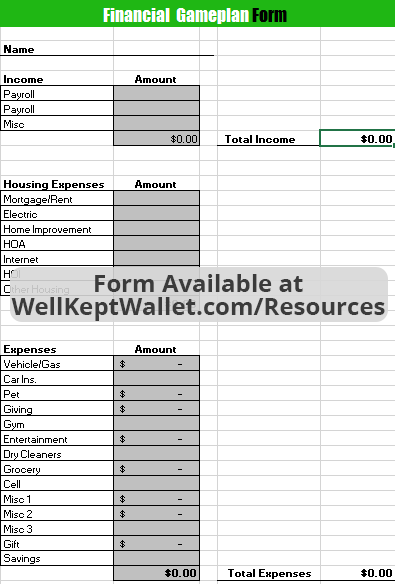

A Financial Game Plan is a form that helps you to get a clear picture of your current financial situation. The Financial Game Plan form lists all monthly expenses, monthly income, asset numbers and liability numbers. The form then assists people in creating a plan for their money that will help them pay off their debts as quickly as possible.

Once the fields in the Financial Game Plan form are completed, it’s time to move on to step 2 in eliminating student loan debt quickly: deciding on your debt repayment strategy.

-

Determine Which Debt Repayment Strategy is best for you

There are two particularly popular types of debt repayment strategies that help people to get their debt paid off faster. The first is called the Debt Snowball, the second is called the Debt Avalanche. Here’s how they work:

Debt Snowball

With the Debt Snowball, you organize all of your debts in order from smallest to largest. You make the minimum payments due on all debts. Then you take any leftover money from your budget and apply it toward the smallest debt.

Once that debt is paid off, you take the payment you were making toward the smallest debt, plus any extra money from your budget, and apply that on top of the current minimum payment due on the next-smallest debt.

After the second debt is paid off, you continue to put all that money toward the third-smallest debt, and so on, until all of your debts are paid off.

The power behind paying off the debts smallest to largest is that you pay off individual debts faster and build the motivation that will keep you working hard toward debt freedom.

Debt Avalanche

With the debt avalanche, you list all of your debts in order by interest rate, starting with the highest rate. You pay the minimum payment on all debts, and throw all extra money in your budget toward the highest interest loan until it’s paid off. You then continue applying all extra monies toward the next-highest interest loan until you’re completely debt free.

The power behind the Debt Avalanche is that you’re paying off the highest interest debts first, which means that you should get out of debt faster than with the Debt Snowball. It’s important to keep in mind that you may not see complete debt payoffs as soon as you do with the Debt Snowball, though, so some people may find it less immediately gratifying.

Both methods of debt repayment are successful and powerful; it’s up to you to decide which debt repayment method will provide the strongest motivation to stick with your goal of complete debt freedom.

-

Determine Your “Why” for Getting out of Debt

You’ve got your plan in place for paying off debt; now it’s time to determine your “why”. Your “why” is the reason or reasons you want to be debt free. Write down your “why” and post it where you’ll see it often.

Your “why” will help you to stick with your plan for debt freedom when your friends are buying new cars or taking expensive vacations.

-

Cut Your Expenses

Cutting your expenses is vital to paying off your student loans quickly. By minimizing or eliminating all unnecessary expenses, you have more money to put toward paying off your student loan debt, which will make your repayment time shorter than ever.

Look at your list of monthly expenses and determine whether or not each one can be reduced or eliminated. Remind yourself that this strict budget is not permanent; it’s simply a means to get your debt paid off faster so that you can have more freedom in your budget without the burden of student loan payments.

-

Increase your Income

Increasing your income is another powerful step toward paying off student loans quickly. In order to increase your income without burning yourself out from overworking, consider this plan:

- Determine how many hours per week you can comfortably set aside for earning extra income

- Make a list of your skill sets that can be used to make extra money in a way that will be fun (or at least bearable) for you

- Make a list of jobs you can do using those skill sets

- Go about searching for jobs that fit your parameters

After your analysis you might find that working extra hours at your full-time job is your best source of extra income. Or you may prefer working a second job. Others find that freelancing or working your own business (such as babysitting or dog walking) is one of the best ways to make more money.

The goal is to earn more money without burning out from overworking or working at a job that you’ll hate.

-

Throw All Extra Money at Debt

Your student loan debt repayment will happen much faster if you throw every dime of extra money toward your debt. Get a birthday gift of money? Put it toward your debt. Get a bonus at work? Put it toward debt. The more money you put toward your debt, the faster you’ll be debt free and back to living on a more carefree budget.

Although working this plan to pay off your student loans quickly may seem burdensome, those who have gone before you and worked hard to eliminate their debt quickly will testify that it was well worth the effort. When you choose to live life free of debt, you open up a whole new world of opportunity for all of your future dreams and goals.

Read more from Deacon on his blog, visit him on Facebook and follow him on his Twitter.