Below is a summary of Federal Student Aid’s explanation of the Biden administration’s updates to student debt relief with our recommendations.

The Repayment Pause Extended for the Last Time

The pause on student loan repayment due to expire on August 31 has been extended until December 31, 2022. Borrowers’ first payment in two years will be due in January 2023.

What you should do:

- The extension pause will automatically be applied, so no action is required.

- Register or visit your IonTuition account to view your January payment

- Enroll in auto-payments with your servicer

- Apply now for an income-driven repayment plan to keep payments affordable

Loan Forgiveness has Been Expanded

The U.S. Department of Education (Department) plans to forgive up to $10,000 in student debt for individuals earning less than $125,000, and households earning $250,000. Pell Grant recipients are eligible for up to $20,000 in loan forgiveness.

The Public Service Loan Forgiveness (PSLF) program has been expanded for borrowers employed by non-profits or the government.

What you should do:

- The Department may automatically qualify you if it has your income data. Otherwise, you’ll need to complete an application for loan forgiveness which should be available before the end of the year

- Check for PSLF eligibility and apply here before October 31st

- Ask an IonTuition advisor if you’re eligible for loan forgiveness

Repayment Plans Are More Affordable

The Biden-Harris administration is proposing a new income-driven repayment plan that would require borrowers to pay 5% of their discretionary income instead of 10%.

The plan would forgive loan balances after 10 years instead of 20 for borrowers with loan balances less than $12,000.

Also, any unpaid interest under the income-driven plan wouldn’t be applied to the borrower’s balance if their required payment is $0.

What you should do:

- Check the income-driven repayment plan tools on your IonTuition account. You may be able to apply for the new income-driven plan entirely on the IonTuition portal.

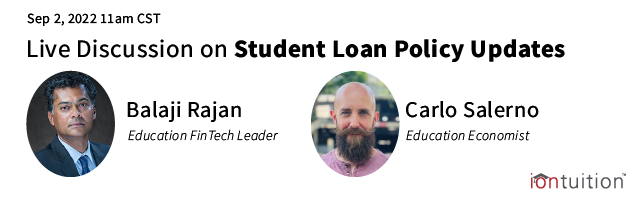

Join Us on September 2nd to Evaluate the Student Debt Relief Updates

We will be hosting live webinar on Friday, September 2nd to evaluate all changes to student debt relief and what it means for borrowers, students, colleges, and employers.

IonTuition users can also contact an IonTuition concierge advisor with questions about repayment.