The Biden-Harris Administration announced it will grant forgiveness to borrowers on the Saving on a Valuable Education (SAVE) Plan beginning in February. Borrowers who originally took out $12,000 or less for college and make ten years of payments will have their debts canceled.

The SAVE plan replaces the REPAYE income-driven repayment plan, which allows for loan forgiveness of the full balance after 20 or 25 years. Under the SAVE plan, for every $1,000 borrowed above $12,000, a borrower can receive forgiveness after an additional year of payments. This means most borrowers with a balance less than $21,000 will still reach forgiveness faster than the original 20-year timeline.

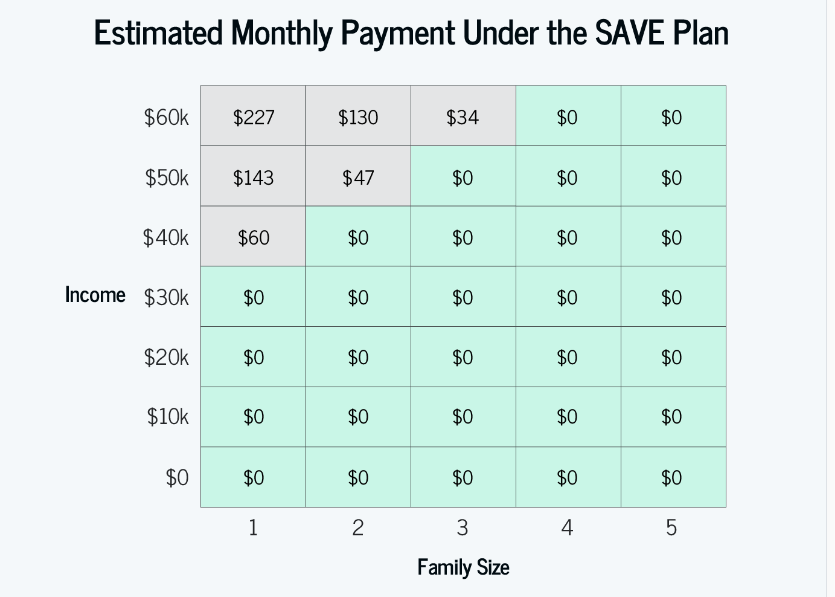

The SAVE plan will be fully implemented this July, and borrowers are encouraged to sign up now. Based on the income levels of student loan borrowers, over 60% of borrowers would qualify for a significantly reduced monthly payment.

Since the Standard Repayment plan for Federal Direct loans is also 10 years, it’s to most borrowers’ advantage to enroll in SAVE.

Previous Payments and the Repayment Pause Years May Qualify and Cause Immediate Forgiveness

If a borrower has already been repaying for 10 years, those years could count towards loan forgiveness. This includes the three-year payment pause, even if no payments were made.

“Periods that count toward the forgiveness benefits include months during the payment pause and time in repayment as determined through the payment count adjustment.”

Department of Education Press Release

Borrowers on SAVE will be notified in February if they are eligible for immediate discharge. If you haven’t already enrolled in SAVE, log in to the ION portal and connect with a loan repayment counselor to get started.