Student Loan Debt Will Continue to be High Even if Forgiveness Happens

The national student loan debt balance is at $1.75 trillion. Even if $400 billion is forgiven, student debt will continue to be one of the largest forms of household debt. The Biden Administration’s student loan forgiveness program is currently under legal jeopardy as we wait for a ruling from the Supreme Court.

Even if the forgiveness goes through, the one-time forgiveness of $10,000 or $20,000 will still leave most working Americans with student loan bills.

Americans Are Not Participating in Retirement Plans

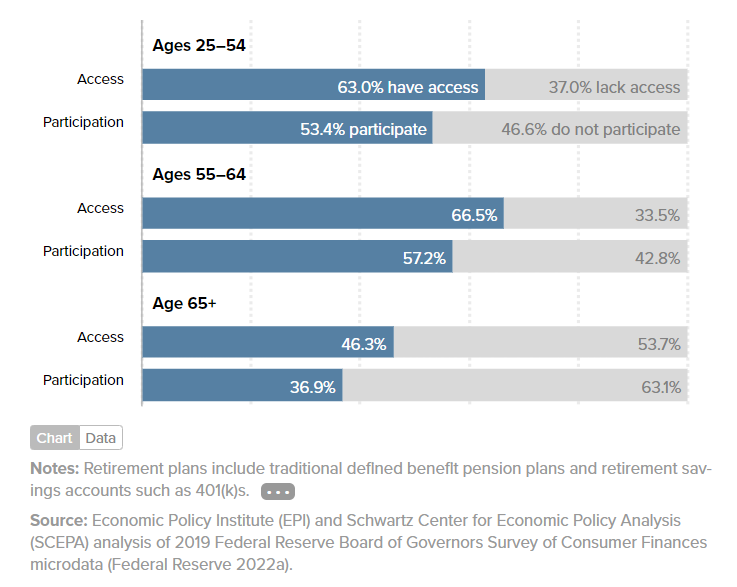

Americans are struggling to repay auto loans, credit cards, and housing bills even during the three-year student loan repayment pause. In addition to a student loan debt crisis, the Economic Policy Institution is also throwing around a looming “retirement crisis.” According to their latest research, retirement plan participation remains low despite the popularity of 401(k) plans.

Over 60% of workers 25 – 64 have access to an employer retirement plan, yet only about half are participating.

Workers can’t participate in retirement plans because they’re paying other bills. When student loan repayment resumes, workers will struggle even more to manage their finances.

SECURE 2.0 Allows Employers to Make Retirement Contributions Based on Employee Student Loan Payments

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was passed in 2019. SECURE 2.0 was signed into law late last year and includes provisions to help workers with student loan debt. The student loan provision goes into effect for retirement plans beginning Jan 1, 2024.

SECURE 2.0 permits employer contributions of up to $5,250 per year to retirement plans based on employee student loan payments. For example, a worker earning $100,000 participating in an employer plan offering a 3% match on 401(k) contributions, can receive $3,000 toward their 401(k) plan if they make $3,000 in student loan payments.

Employers Have an Opportunity to Recruit & Retain Talent

If your industry requires a college-educated workforce, SECURE 2.0 is a perfect way to recruit and retain talent. ION can help companies track worker student loan payments to validate matching retirement plan contributions. Contact sales@iontuition.com to set up your company’s SECURE 2.0 employer contributions program.