Your student loan payments matter when doing your taxes. We’re not tax professionals, so we don’t offer advice on taxes, but we do know this much:

Most borrowers can deduct up to $2,500 of the student loan interest they paid last year!

Student loan interest reductions are now part of the basic instructions when filing your taxes, whether you do them yourself or use a tax preparer.

Am I eligible?

You qualify for this deduction if you:

- • File as Single, Married, or Married filing jointly

- • Are not claimed as a dependent on somebody else’s taxes

- • Paid interest on student loans owed by yourself, your spouse, or your dependent

- • Used the student loan to pay for qualified education expenses such as tuition, fees, books, equipment, or room and board, and

- • Have a Modified Adjusted Gross Income (MAGI) below the limit set by the IRS – $160,000 if married filing jointly, $80,000 if filing single, head of household, or qualifying widow(er)

Click here for more information on determining your MAGI.

What tax documents do I need?

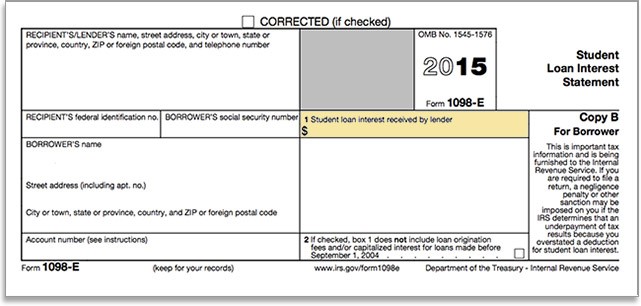

If you paid more than $600 in student loan interest last year, your servicer will be sending you a 1098-E Tax Form. This is a very basic form containing all the student loan interest payment info you are likely to need when you file. If you have not received your form yet, or if you paid less than $600, you should contact your servicer directly for assistance.

Log into your iontuition account to look up your servicer’s contact information.

You can also determine the interest paid by looking at last year’s account statements from your servicer. Depending on their format, you may be provided with a total interest paid for the year on each statement, or you may need to add up the monthly total. Either way, interest that is paid is generally reported.

Remember, only interest paid is tax deductible. You CANNOT deduct your whole student loan payment if any portion of that payment went toward your loan’s principal balance

If you have any questions when filing your taxes, consult with a qualified tax professional.