When you attend college, the last thing you want to think about is student loan repayment. Repayment is far in the future, right? Wrong.

College goes by faster than you think and you will need to repay your student loans. The average student loan payment is $242 a month, according to the Brookings Institute. That’s a car payment. And you still need to pay your other bills like rent, utilities, burritos, and so on. The best way to get a head start on your student loans is to start paying the interest while you’re still in school.

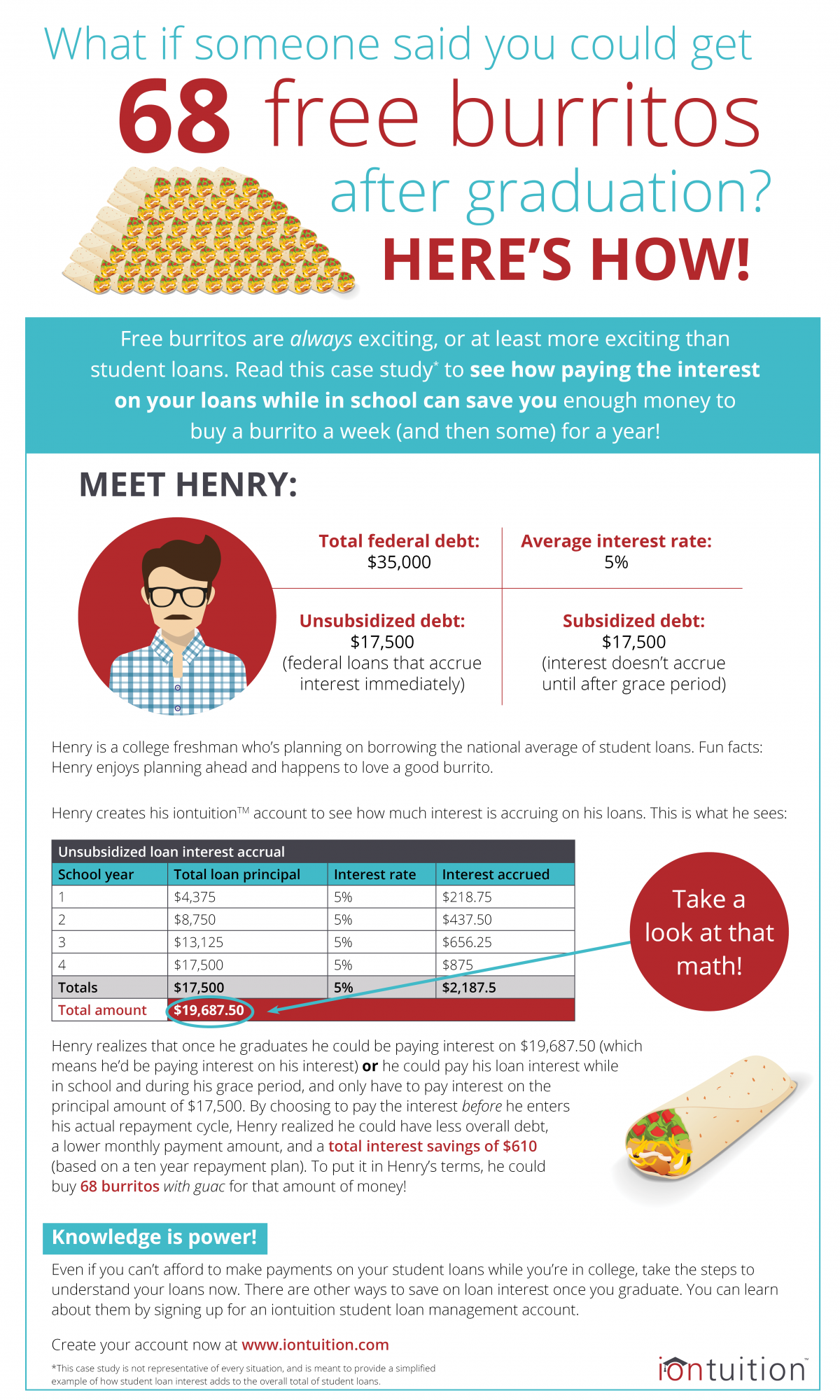

If you have a subsidized federal student loan, the interest is already paid by the government until after you leave school. Any unsubsidized federal student loans you have are treated differently. The interest on those loans starts to accrue from the day they are disbursed. Unless you pay the interest while you’re still in school, it gets added to the total amount you’ll need to repay.

Luckily, you can take action now to keep your student loan payments manageable later – pay the interest while you’re in school. You can save yourself hundreds of dollars over the lifetime of the loan. This leaves you with less student loan debt when you leave school, lower payments throughout the life of the loan, and significant long-term savings (more than $600 in savings in the example below). That means more money in your pocket for other things… like really big burritos.

NOTE: If you received an email from iontuition, your school has provided you with a free iontuition account. Activate your account or log in now to see your loan balance.