Revised Pay As You Earn (REPAYE), a new federal student loan repayment plan, has been in the news a lot the past few weeks. And with the alphabet soup of repayment plans like PAYE, IBR, and ICR, it’s hard to know if you should pay attention. Here are the answers to five common questions about REPAYE to help you determine if it’s the right student loan repayment plan for you.

What is REPAYE?

REPAYE is a revision of PAYE. According to Federal Student Aid, REPAYE will allow an additional five million federal direct student loan borrowers to take part in the PAYE plan, lowering their monthly payments.

With REPAYE and PAYE being used interchangeably by many people, keep in mind REPAYE is a revision of PAYE – they are not separate programs. Come mid-December, the revised PAYE plan will go into effect.

What is PAYE?

PAYE (Pay As You Earn) is a student loan repayment plan introduced in December 2012 as a way to help student borrowers lessen the burden of their student loan payments. When it was introduced, it offered many borrowers the lowest monthly payment amount of all repayment plans based on income, family size and state of residency.

Let’s take a closer look at how PAYE helped reduce student loan payments:

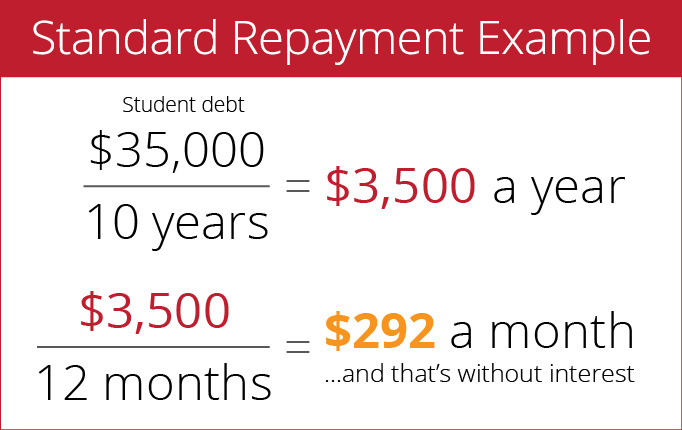

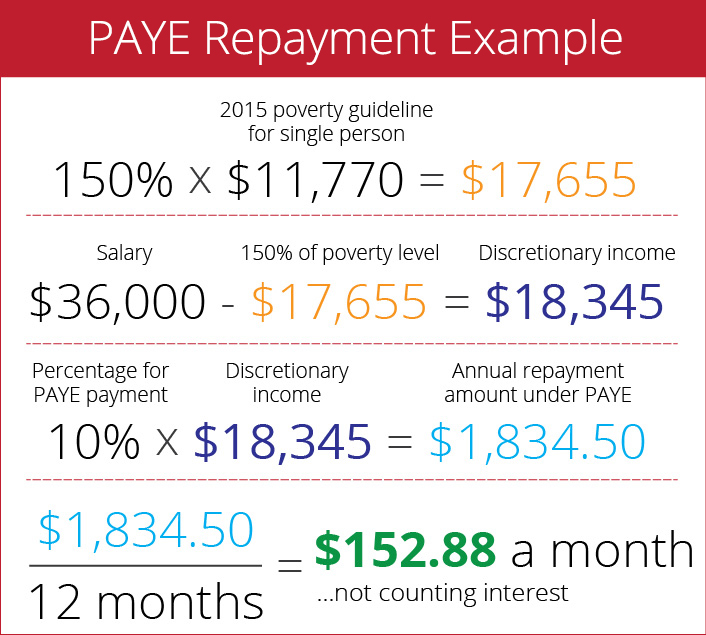

Let’s say you make $36,000, the average starting salary for a liberal arts degree, and you have $35,000 in student loan debt.

Under the Standard Repayment plan you would make a set payment amount each month for ten years.

Depending on your interest rate, your monthly payment could jump to more than $400 on the Standard Repayment Plan.

Under PAYE, your student loan repayment is 10 percent of your discretionary income.

Here’s how to calculate your discretionary income:

Subtract 150 percent of the poverty level for your family size and state from your salary. The 2015 poverty guideline for a single person is $11,770 for all states besides Alaska and Hawaii.

Again, that’s not counting interest, but you can see how much of a difference PAYE made for many student loan borrowers struggling to make their payments.

With PAYE, the less money you make, the lower the payment. If you happen to lose a job and have no or very low-income, the payment could actually be zero. Don’t forget, even if your payment is zero, interest still accrues under PAYE.

Why did PAYE need to be revised?

Although PAYE helped a lot of student loan borrowers, only those who took out their first loan on or after July 1, 2014, were eligible. REPAYE allows any qualified borrowers, regardless of when they took out their loans, to participate.

Under PAYE, interest was still charged on the loan, even if your payment was zero. Let’s say you struggled to find a job after graduating and didn’t have an income. You have $35,000 in student loans with an average interest rate of six percent. Under PAYE, your monthly payment could be as low as $0 per month, but your total loan balance of $35,000 would increase to $37,100 over the course of a year because of interest. That’s not very fun for borrowers who struggled to make their payments to begin with.

The REPAYE plan includes an interest subsidy for up to three years if your monthly payment doesn’t keep up with mounting interest. That means if your student loan payment doesn’t cover the interest, the Department of Education will pay the interest for three years to prevent it from adding too much to the overall cost of the loan. After that, the Department will pay for half the interest each month. Remember, that’s only if your payment doesn’t cover interest. Otherwise, you’ll still have to pay it.

Do I qualify?

REPAYE is reserved for borrowers with student loan debt of at least $10,000. As your income increases, so does your payment. Your spouse’s income also will be taken into account and you’ll need to provide income information each year.

To find out if you can qualify for the plan, create an iontuition account. If you get confused, contact our loan counselors with your questions. They can guide you and tell you how to apply.

What are the benefits and drawbacks?

The most obvious benefit is you will have a payment you can afford. And after making regular, timely payments for 20 years, any student loan debt in the plan that remains can be forgiven.

However, forgiven student loan debt can be considered as income by the Internal Revenue Service and taxed. Plus, stretching payments out from the original 10-year term to 20 years will add to the total cost of the loan and cost you more money in the long run.

Even if you do qualify for REPAYE, look into other repayment options like Income-Based and Income-Contingent plans. Payments under other plans could be lower depending on your circumstances. There are a lot of student loan repayment options these days. Make sure to research all of them, and if you get stuck, call an iontuition loan counselor for help