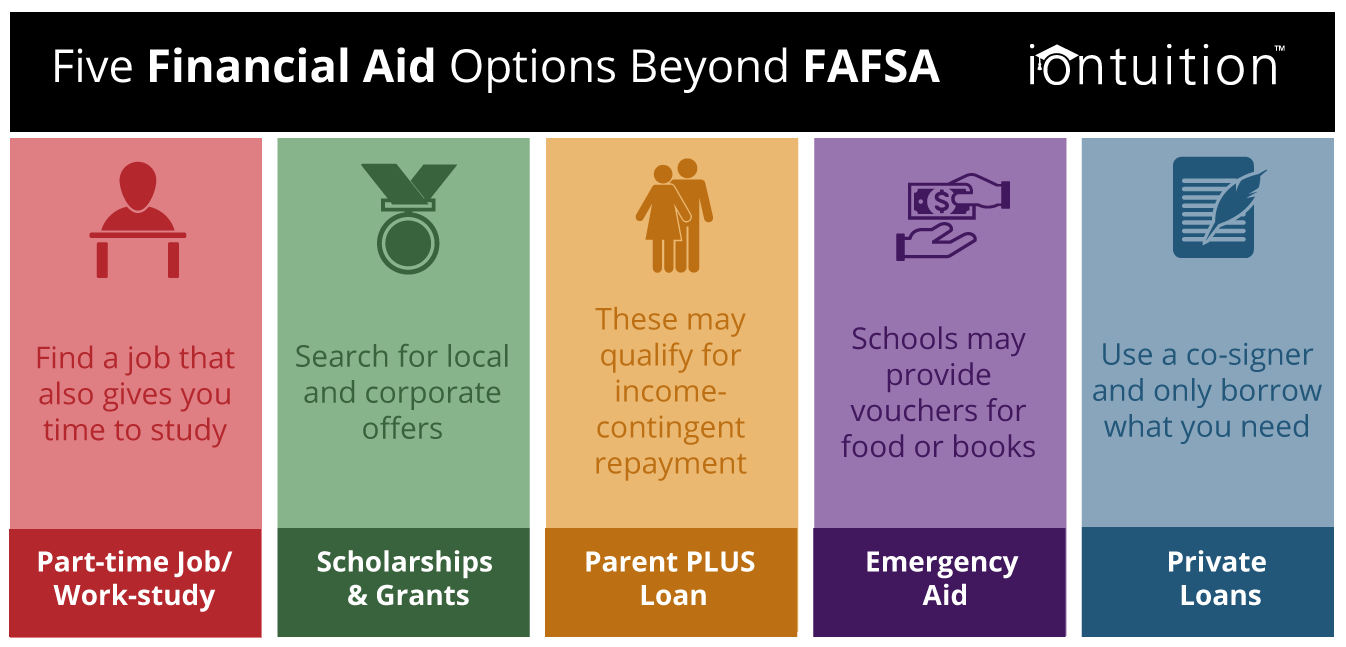

Nearly 20 million students borrowed billions of dollars to pay for college through FAFSA last year. However, FAFSA doesn’t always cover all higher education expenses and many families find themselves financially strained during the school year. For those whose Federal aid fell short, consider the following options.

Improve Your Income

In 2015, 43 percent of full-time undergraduate students were employed while in school; the majority of whom worked less than 35 hours per week. Even working a couple hours per week can add up. The Federal Work-Study Program can help you find a job related to your course of study. However, many students find part-time jobs on campus in cafeterias, libraries, and various “front desk” positions. Hours are flexible, and many allow you time to study while at work.

Search for Scholarships and Grants

The U.S. Department of Education and the nation’s colleges award an estimated $46 billion in grants and scholarships each year, but they’re not the only ones. Check with your financial aid office or guidance counselor for a list of local scholarships and work your way up through corporate, state, and federal scholarship opportunities. Many corporations offer scholarships to their employee’s families but also have scholarships for the general public. Apply for as many scholarships and grants that you can. Many programs only ask for a scholarship essay. Other scholarships are awarded based on course of study, academic achievement, or athletic ability.

See if your parents would be willing to help with a PLUS Loan

Direct PLUS Loans are available for dependents that still need money. Parents can borrow up to $5,000 on your behalf depending on their credit. These loans are often a better choice than a private student loan because they have an income-contingent repayment and forgiveness option. However, parents should be aware that these loans cannot be transferred to their dependents. Parents can apply through StudentLoans.gov or through your school’s own application.

Seek Emergency Aid

If you or your family have experienced an unexpected expense, ask your financial aid office if your school has an emergency aid option. Some schools may be able to obtain an advance on your federal aid, offer their own loan, or provide a range of services to ease your financial burden such as campus vouchers for food or books.

Take out a Private Loan

When federal aid isn’t enough, private loans become an option. Private loans will require a credit check so be sure that you have strong credit or find a co-signer who does. While it’s never ideal to take on more debt, completing a college education is still the best way to land a high-paying job.