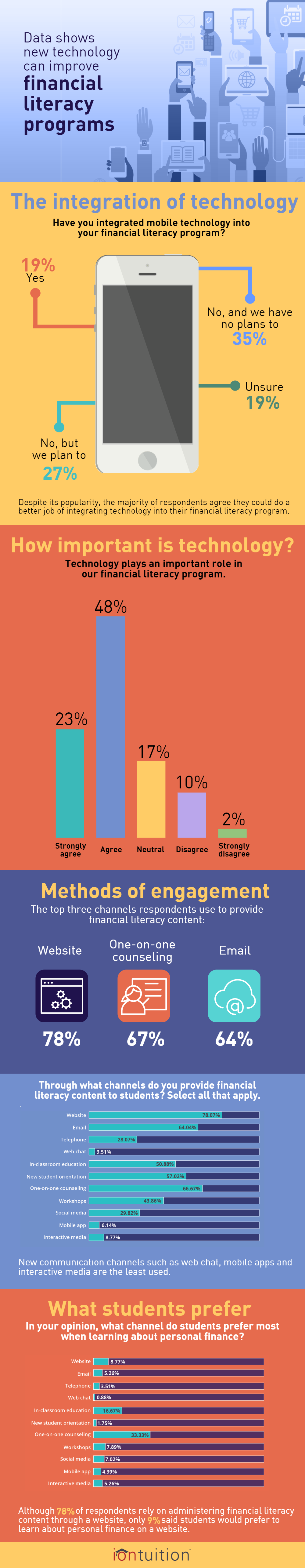

In our 2016 Financial Literacy Trends on Campus Survey, we asked financial aid professionals about the state of their financial literacy programs, including their challenges, overall effectiveness, budget, resources and future plans. The data overwhelmingly shows that technology plays an increasing role in financial literacy, both in delivering the content to students and in marketing the program.

Despite its growing importance, the majority of respondents agreed they could do a better job of integrating technology into their program.

Key findings from the financial literacy report:

– Only 18 percent of respondents have integrated mobile technology into their financial literacy program.

– 80 percent of respondents agree that they could do a better job integrating technology into their programs.

– The top three channels respondents use to provide students with financial literacy content include website, one-on-one counseling, and email.

– New communication channels are used the least; webchat (4 percent), mobile apps (6 percent) and interactive media (9 percent).

The infographic below will provide you with a better understanding of how financial aid professionals integrate technology into their financial literacy programs.