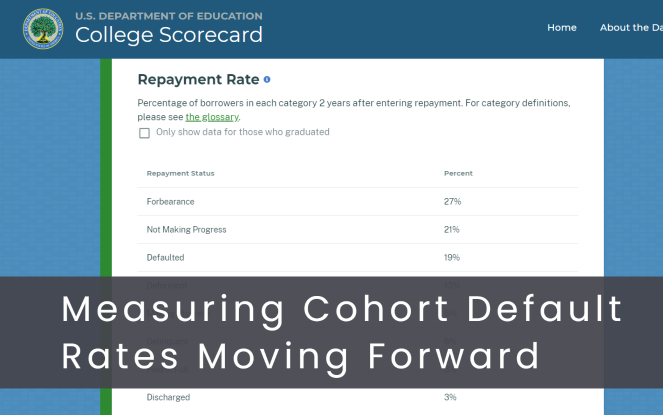

There are several immediate impacts of policy and other changes related to the Cohort Default Rate (CDR) measurement for colleges and universities.

Right or wrong, CDR is key to institutional quality ratings. The higher the CDR, the lower the institutional quality.

Default has been a major issue for students with severe punitive consequences such as poor credit ratings, administrative wage garnishment, and so on. This is why cohort default rate measurement is so important.

Institutions of higher education should make preparations now to maintain low CDR percentages after repayment resumes.

COVID Changed Everything.

One – the Education Department (ED) ceased repayment. This resulted in every borrower becoming current on their loans. The CDR is practically zero.

Two – ED introduced the Fresh Start initiative to put all defaulters in current status and continue in that manner as long as they made a valid repayment arrangement within 12 months.

Three – Policymakers are considering punitive measures where institutions will repay part of a student’s federal loan if the student defaults and other conditions.

Four – Multiple Federal servicers have terminated their contracts and ED continues to have systems issues.

Higher education institutions must manage two chaotic events

First — Address Delinquency and Default Early

Start educating your students early, before they leave school. Implement a more intensive default aversion plan immediately. Ensure that your third-party servicer has performance requirements, like the percentage of borrowers in forbearance, current, etc.

Second — Focus on New Retention Tools

Begin to implement plans to improve your student outcomes. Offering a financial and student loan management tool is not enough. You must work on improving retention through wrap-around support, including mental health services. Stress is one of the leading causes of students dropping out of college.

Contact ION at sales@iontuition.com to request more information on how to set up your default aversion program.

Check out our blogs:https://www.iontuition.com/iontuition-blog/

Nelnet recently laid off 550 associates at a time when servicers told GAO they would need to hire over 4,500 new employees. Read More.