Student loan refinancing offers seem to be everywhere. For someone with troublesome student loan debt, refinancing can be tempting. Advertisements generally claim to offer lower interest rates and lower monthly payments, and who doesn’t want that?

Refinancing federal student loans tends to be risky, though. You must be willing to give up a whole range of government protections that you can’t get with any type of private loan. It’s also important to keep in mind how your credit score can impact your refinancing, particularly when dealing with variable interest rates.

Your Financial Health Affects Your Interest Rates

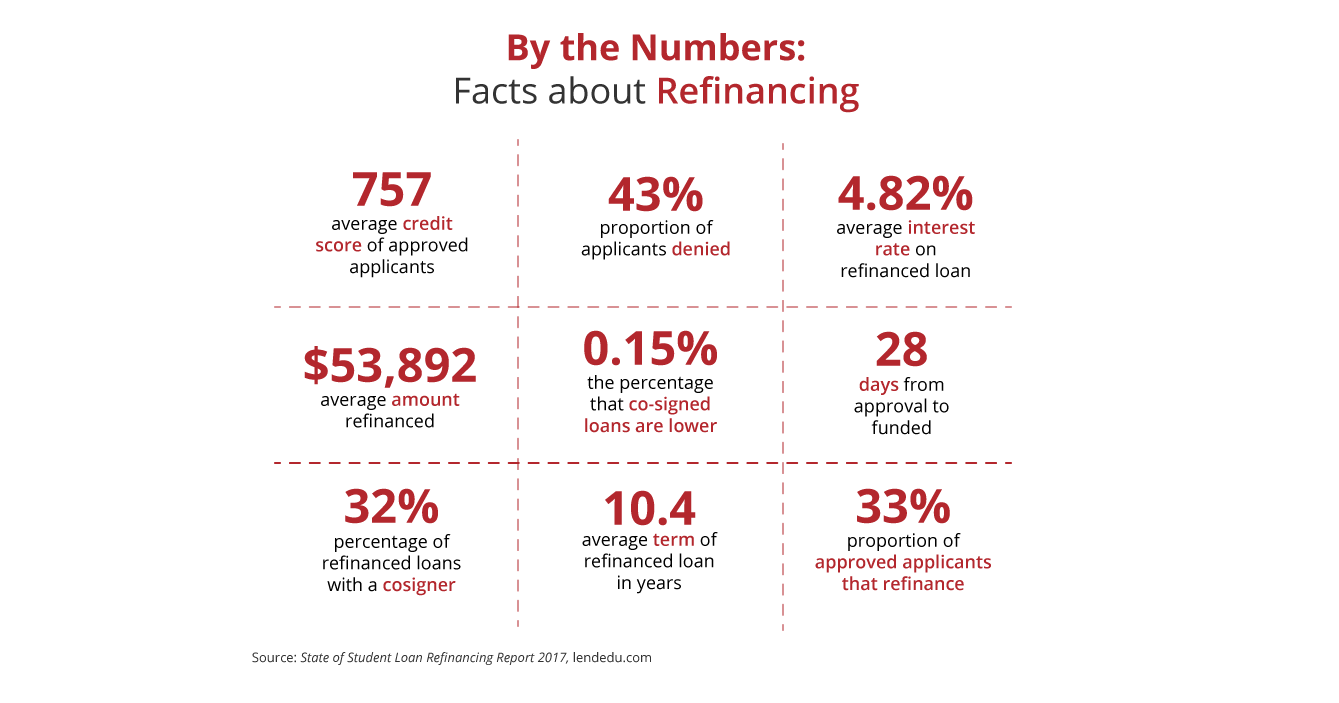

Student loan refinancers offer similar benefits to refinancing a mortgage or auto loan. As with those loans, your credit score, salary, financial history, and numerous other factors will be considered to determine the interest rate and repayment period you are offered. If your credit score is 760 or above and you have adequate income, refinancing your education debt may be a very smart choice. If you have a lower credit score or somewhat unstable income, trying to refinance may be more trouble than it’s worth.

Weighing Refinancing against Government Protections

Federal student loans are designed so that there is always a way to stay current on your loans. Deferment, forbearance, income-driven repayment, even forgiveness, are all available.

Refinancing offers, on the other hand, promise to lower monthly payments by consolidating loans into one simple repayment plan that often has a lower interest rate. They replace your existing student loans with one loan disbursed from a private lender.

The important thing to think about is whether you are confident that benefits (e.g. lower interest rates or lower total repayment) will outweigh the risks (e.g. no flexibility during financial hardship and no forgiveness options).

Consider Your Goals

Whichever refinancing or repayment plan you choose, it’s important have a clear picture of what’s available to you and what you want to achieve.For refinancing, thoroughly research what’s offered through your company’s student loan refinancing plan, but also investigate other trusted lenders.

For choosing a federal repayment plan, make sure you understand your current plan thoroughly and contact your servicer to learn about other benefits that may be available to you.

Some things to consider as you begin your research:

- How do the interest rates for all of your existing student loans as compare to the interest rates offered by refinancing companies?

- Will you need to increase your credit rating before applying for refinancing to secure a reasonable deal?

- Are your job and career field stable enough to let you take on refinancing, knowing that you will have lost valuable protections?

- Can you be fairly certain that your salary will increase steadily over time?

- Does your lifestyle allow you to create a substantial emergency fund today?

Make Smart Decisions

Finding the best options for managing your student loan debt requires diligent research, careful consideration, and a long-term plan that fits your lifestyle. Be certain you know what you want to do and remember that once you’ve refinanced, there is no going back.

To learn more, sign in or sign up to visit our refinancing section on IonLearn.