Beware of Student Loan Scams

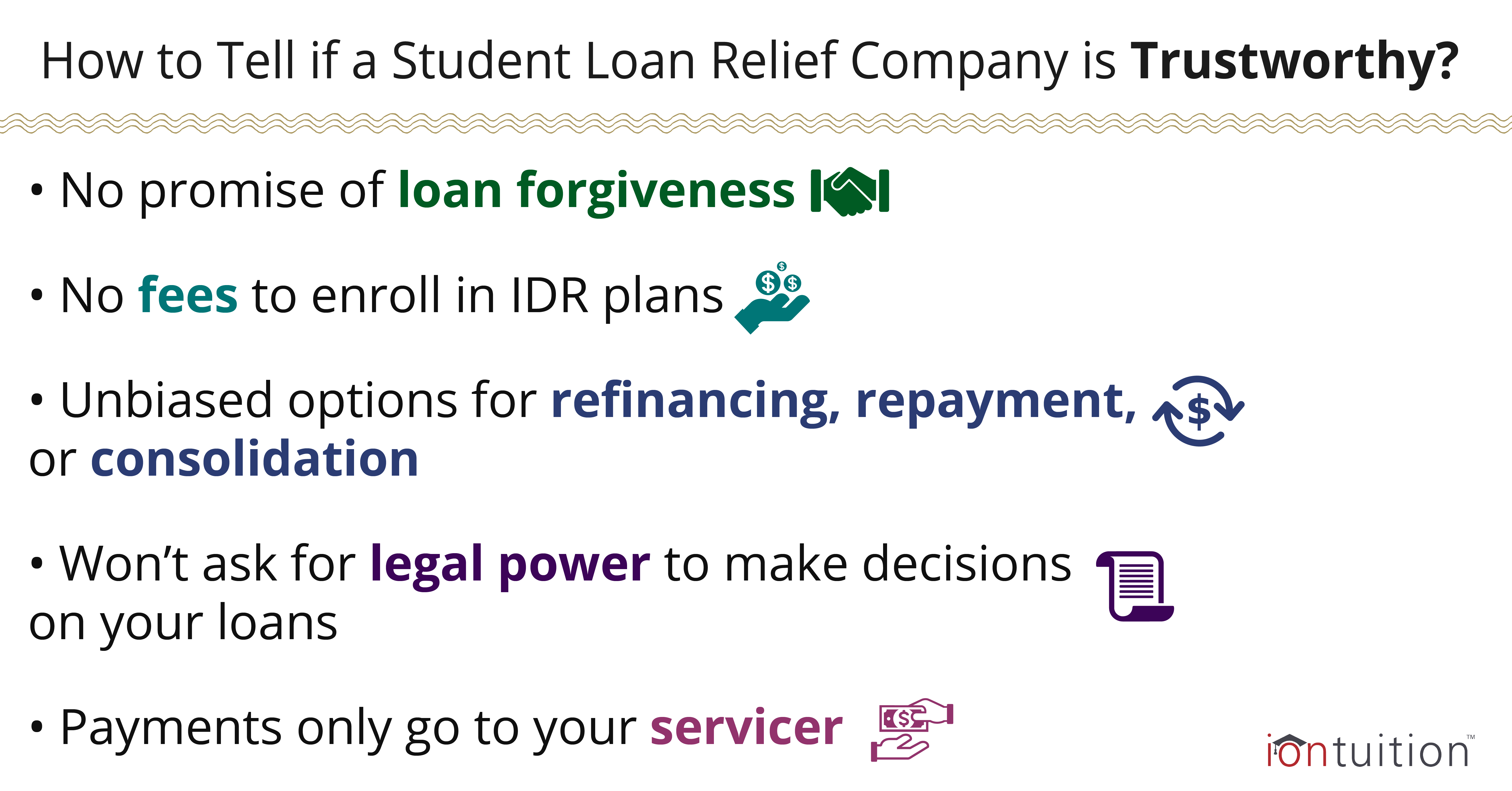

Earlier this year, a federal court in south Florida placed an injunction on a company for providing fraudulent student loan debt relief. That company falsely promised to enroll borrowers in repayment or debt-forgiveness programs. Reports show that the company’s telemarketers were promising loan forgiveness in five years or less. Borrowers were charged a mandatory $750 fee to enroll in a debt relief program.

Unfortunately, the list of untrustworthy student loan relief companies is growing. Student loan debt continues to swell and affect people’s financial well-being. Fraudsters are taking advantage of distressed borrowers by offering an easy way out of their debt. Even though there are ways for borrowers to control their debt without having to pay anything.

You Shouldn’t Have to Pay Money to Get Money

Federal income-driven repayment and public service loan forgiveness are government programs and cost nothing to apply. These consumer protections are designed to help student loan borrowers avoid default and the office of Federal Student Aid encourages student loan borrowers to take enroll. Many companies act as an intermediary and do nothing more than provide and submit the paperwork. It’s unethical for a company to ask for an origination fee to place you into a free program, but it’s fraudulent if the company accepts payment if you never enroll in a relief program at all.

Loan Consolidation is Also Free for Federal Borrowers

There a number of companies offering to consolidate your student loans and charging a consolidation fee up to $1,500. You can consolidate your federal loans for free through StudentLoans.gov. The companies charging to consolidate your loans are choosing your consolidation program, filing the paperwork, and answering your questions. These companies also ask for Power of Attorney to act on your behalf with student loan companies, which could result in you paying even more.

Find a Trustworthy Student Loan Advocate

Look for companies that are honest and impartial when it comes to helping with your student loan repayment. Most importantly, find a company that doesn’t charge to help you enroll in programs that are available for free. Learn more about how IonTuition can become your trustworthy student loan partner.