Blog.

Risks for Non-Profits: Falling Enrollment & Rising Defaults

Last year, at least 16 non-profit institutions closed due to enrollment and financial challenges. This is a rising trend of non-profit closures since 2020, which we wrote about before. This year marks the start of the demographic enrollment cliff, where we expect a...

2026: Student Loan Default Crisis, Funding Gaps, and Private Loans

As 2025 closes, institutions are focused on curing the record number of delinquent student loan borrowers from the FY 2024 cohort, while still keeping an eye on the 2025 and 2026 cohorts. As we look to 2026, there are big changes scheduled for July 1, 2026. That date...

Is It Too Late to Implement a Default Aversion Plan for the FY 2024 Cohort?

No, it's not too late to implement your default aversion plan for the 2024 Cohort. The window closes soon. Many institutions have not had to worry about CDRs over the last five years when payments were paused and delinquent students were placed into administrative...

Student Loan Default Cliff is Here

The student loan default cliff has arrived. For a full year, the Department of Education’s “on-ramp” period shielded borrowers from the harshest consequences of non-payment. However, we have now crossed a critical threshold: the first wave of borrowers who missed...

Student Loan Payments Set to Rise Under OBBBA

The “One Big Beautiful Bill Act” (OBBBA), signed into law on July 4, 2025, implements significant, cost-saving changes to the federal student loan system. The provisions, which reduce federal financial aid and the student loan program by nearly $300 billion, create an...

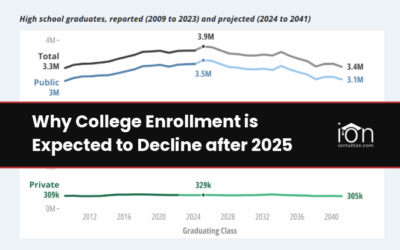

Why College Enrollment is Expected to Decline After 2025—and How Schools Can Prepare

At the start of the year, we wrote about the upcoming "demographic cliff" in higher education. The warning was simple: the decline in birth rates during the 2007-2009 Great Recession will soon catch up to colleges. While some schools are experiencing record...

Student Loan Delinquency, Non-Payment Rates Foretell High CDRs

The looming threat of student loan defaults is here. With less than six weeks until borrowers officially default for the first time in five years, the clock is ticking for colleges to implement default aversion plans and limit their 2024 Cohort Default Rate (CDR). The...

Institutional Non-Payment Rates Cause Concern for Colleges

2025 is an unprecedented year for federal student loans. We’re seeing the largest delinquency rates in history, creating a critical situation for institutions to avoid loss of Title IV due to high Cohort Default Rates. To address the rising delinquency rates, the...

Federal Student Aid Publishes Nonpayment Rates of Institutions

The U.S. Department of Education's Federal Student Aid Data Center has released a critical new report: non-payment rates by institution. This data reveals that over 1,000 post-secondary institutions have non-payment rates exceeding 30%, placing them at significant...

Federal Student Loan Repayment Changes Coming

Federal student loan repayment will undergo significant changes beginning next year due to the recent passage of the "One Big Beautiful Bill." Additionally, discussions and actions by the current administration indicate a move to restructure or downsize the Department...