The looming threat of student loan defaults is here. With less than six weeks until borrowers officially default for the first time in five years, the clock is ticking for colleges to implement default aversion plans and limit their 2024 Cohort Default Rate (CDR). The Department of Education has made it clear it’s monitoring colleges’ serious nonpayment rates as detailed in the May 5th Dear Colleague Letter.

Here’s where we stand:

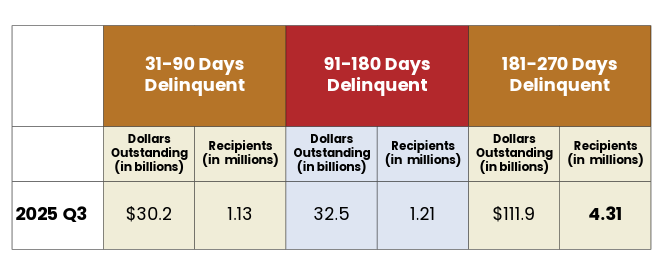

Borrowers 181+ Days Delinquent are 7x Pre-COVID Figures

The latest federal student loan portfolio data reveal that over 6 million student loan borrowers are delinquent on their payments. Of particular concern, the number of borrowers in the 181-270 Days Delinquent status reached an unprecedented 4.31 million as of FY2025 Q3. This is a massive increase compared to the average of just 0.55 million borrowers in the same category between 2016 and 2020. This seven-fold increase in serious late-stage delinquency is a clear warning sign.

Our CDR Health Checks show that a majority of schools have delinquency rates higher than ever before. Many of these institutions are now at risk of seeing their 2024 CDR exceed 30%, which could jeopardize their Title IV eligibility.

IDR Backlogs and Servicer Changes Are Adding to Borrower Confusion

Borrower confusion is a major factor in these rising delinquency rates. According to this recent court filing shows that nearly 1.4 million income-driven repayment (IDR) applications were still pending as of July 31, with only 300,000 processed in July. This four-and-a-half-month backlog provides more than enough time for a late-stage delinquent borrower to default while awaiting approval.

To make matters worse, some servicers have encouraged borrowers to resubmit their IDR applications, adding to the administrative burden and frustration. Additionally, MOHELA borrowers may be moving to a new servicer, a type of transition that can cause more chaos. The Consumer Financial Protection Bureau (CFPB) has found that such transfers are prone to borrower data loss or corruption, making it nearly impossible for the new servicer to connect with transferred borrowers. This environment of uncertainty and frustration only exacerbates non-payment.

Third-Party Servicers Like IonTuition Are Here to Help

As a college or university, waiting for official default rates to rise is a strategy that puts your institution’s financial stability and access to federal aid at risk.

IonTuition offers a strategic solution to this crisis. Our default aversion plans empower your institution to:

- Connect with delinquent borrowers, guiding them back into sustainable repayment options to avoid default

- Provide personalized, expert counseling to help students navigate the confusing and ever-changing landscape of repayment plans.

- Significantly lower your institution’s CDR, protecting your access to federal funding.

The current high delinquency and non-payment rates are a clear indication of a default crisis ahead. Contact sales@iontuition.com today to implement a default aversion plan.