The student loan default cliff has arrived. For a full year, the Department of Education’s “on-ramp” period shielded borrowers from the harshest consequences of non-payment.

However, we have now crossed a critical threshold: the first wave of borrowers who missed their first payment in October 2023 is now crossing 360 days of delinquency.

This marks a pivotal moment for institutions. While the administrative process takes time, the borrowers who cross into default directly impact your Cohort Default Rate (CDR). With an unprecedented 6 million borrowers delinquent across the FSA portfolio, this is a live crisis that demands immediate attention to mitigate the fallout.

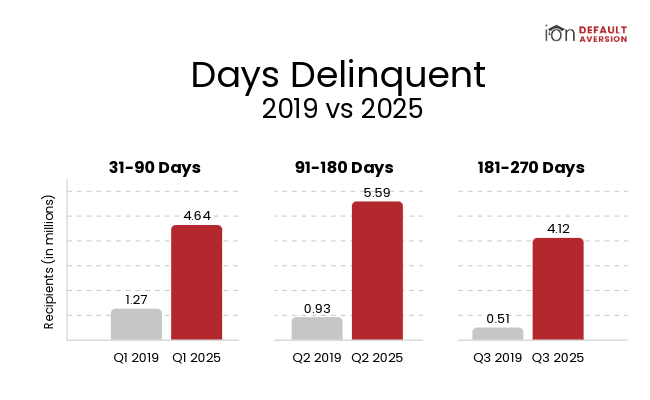

Tracking the current rate of delinquencies by quarter, there are 6 to 8 times more borrowers delinquent than in 2019, before the COVID payment pause.

What the 360-Day Mark Means for Colleges

For institutional leaders, the end of the on-ramp and the passage of the 360-day period is a wake-up call following the past years of 0% CDRs.

The CDR Timer is Running

The FY 2024 Cohort consists of borrowers who entered repayment between October 1, 2023, and September 30, 2024.

- June 28, 2025: Borrowers who missed their October 2023 payment reached 270 days delinquent, reaching “Technical Default”.

- September 26, 2025: The first cohort of borrowers hit 360 days delinquent, which is the point where this default status begins to be counted for CDR calculation.

- The monitoring period for this FY 2024 CDR calculation continues through September 30, 2026.

CDRs are a measure of risk over a three-year period. High delinquency today directly translates into high default rates tomorrow. The institutional goal should be a CDR below 15% to ensure no hold is placed on disbursement. If you’re unsure where your delinquency rates are, request a CDR HealthCheck.

The Threat of Sanctions is Real

The sheer volume of non-payment puts institutions at risk. Our CDR HealthChecks show many institutions are currently reporting over 35% delinquency for the 2024 cohort.

A CDR over 40% in a single year or three years over 30% could cause the loss of Federal Title IV eligibility.

The Department of Education reported in July 2025 that 1,110 colleges were already at risk of losing taxpayer-funded student aid due to high CDR.

Servicer and Systemic Barriers are Compounding the Crisis

The crisis is not entirely blamed on borrowers alone. Systemic issues have worsened the issue:

- IDR Backlogs: A massive backlog exists, with millions of IDR applications currently at a standstill.

- Application Confusion: Borrowers who applied for an IDR plan before April 27, 2025, were told to reapply if their application had not been processed, adding to borrower confusion and potential missed deadlines.

- Servicer Strain: Federal servicers are struggling to handle the volume, with compensation models that incentivize lower service levels when borrower volume increases.

Your Solution: A Comprehensive Default Aversion Strategy

Your institution cannot rely on external factors to save your CDR. The students now in the 360+ day delinquency category are the clearest signal that a robust default aversion plan is necessary.

IonTuition provides the essential tools to intervene effectively and protect your institution. Contact IonTuition today to implement a default aversion plan and secure your institution’s future.