Blog.

Student Loan Borrowers Reach Technical Default for First Time in 5 Years

For the first time in five years, student loan borrowers are reaching the 270-day delinquent point, a status known as "technical default." This is essentially the "final notice" for borrowers before they officially default on their loans....

Student Aid Overhaul: The Senate’s Proposed Changes to House Bill

Just as the House passed its sweeping reconciliation bill, the U.S. Senate Committee on Health, Education, Labor & Pensions (HELP) has released its own "historic legislation" to reform student aid and higher education. While both chambers address student debt and...

Repayment Assistance Plan (RAP) and Other Proposed Changes in the Reconciliation Bill

Congressional Republicans are advancing a budget reconciliation package that proposes a significant overhaul of the federal student loan repayment system, including a Repayment Assistance Plan to replace IDRs. Understanding these proposed changes is critical to...

Federal Student Loans Could Change Under Budget Reconciliation Bill

The House Education and Workforce Committee's "Student Success and Taxpayer Savings Plan" would drastically change federal student loans and financial aid. This is a Congressional Republican initiative through a budget reconciliation bill in the House. Senate changes...

Department of Education Calls on Colleges for Student Loan Default Aversion

The reverberations of the Department of Education's recent "Dear Colleague Letter" (GEN-25-19) are being felt across higher education institutions nationwide – and for good reason. This isn't just another administrative update; it's a clear call to action, urging...

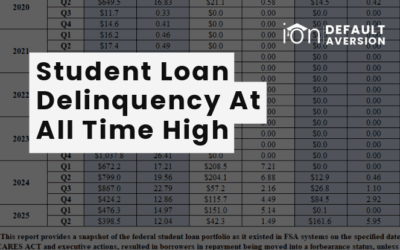

New Data: Federal Student Loan Delinquency at Record High Levels

New data released by Federal Student Aid paints a stark picture of the post-pandemic student loan repayment landscape. The numbers reveal a 6.5-fold increase in borrowers 91-180 days delinquent compared to the pre-COVID payment pause. As of FYQ2 of 2025, a staggering...

Protecting Higher Education Budgets

The growing challenges facing higher education present significant threats to college budgets. Proposed legislative changes and a looming default crisis threaten to strain institutional resources. To protect higher education budgets, colleges must prepare against...

Student Loan Defaults: What Colleges Need to Know Now

The changes within the Department of Education and Federal Student Aid raise concerns about the rising threat of student loan defaults. While the Q1 2025 data for student loan delinquency is pending, the Q4 2024 data showed delinquency rates that were three times...

IDR Applications Back Online After Court-Mandated Revision

Good news for student loan borrowers! The U.S. Department of Education’s Office of Federal Student Aid (FSA) has reopened the online income-driven repayment (IDR) plan and loan consolidation applications. This comes after a temporary pause necessitated by a recent...

What Closing the Department of Education Means for Student Loans

The White House issued an executive order to begin the shutdown of the Department of Education. While the full implications remain, colleges can prepare for changes to how federal education programs are administered. With the potential chaos on student loans after the...